DEF 14A: Definitive proxy statements

Published on March 13, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||

| Payment of Filing Fee (Check the appropriate box): | ||||||||

| x | No fee required. | |||||||

| ¨ |

Fee paid previously with preliminary materials: | |||||||

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||

PROXY STATEMENT

and notice of annual meeting of shareholders

Wednesday, April 26, 2023 at 3:00 p.m. Central Daylight Saving Time

www.virtualshareholdermeeting.com/DLX2023

March 13, 2023

Dear Deluxe shareholders,

Since January 2019, Deluxe has consistently communicated its goal of becoming a Trusted Payments and Data Company™. Thanks to the dedication and commitment of thousands of Deluxers, we have achieved that goal. 2022 marked our second consecutive year of organic revenue growth for the first time in more than a decade, and we generated the highest revenue in the company’s history. In the first half of 2023, we believe Payments will be our largest revenue business, further evidence of our transformation to a Trusted Payments and Data Company™.

Last year’s results demonstrate our continued commitment to putting customers as the driving force behind our future:

1.All four segments—Payments, Data Solutions, Promotional Solutions, and Check—hit or exceeded their revenue targets for 2022.

2.As a result of our continued innovation and investment in our Payments business, we secured key wins with several of the nation's largest financial institutions and launched 11 new products to provide a more robust offering to our Payments customers.

3.With our enterprise resource planning software going live in 2023, we took the last step in our “Six Flags” technology initiative. We've now completed the migration of legacy systems to more modern platforms, enabling us to more successfully cross-sell to our customers and streamline business efficiencies.

4.We continued to evolve our executive leadership team, including hiring Yogaraj Jeyaprakasam as Chief Technology and Digital Officer to further entrench a digital mindset at Deluxe, with technology at the forefront of everything we do.

As proud Deluxers, we continue to work side-by-side, fostering a culture that enables us to provide value to our employees, customers, partners, and shareholders.

Please join our virtual annual meeting on April 26, 2023. Even if you do not plan to attend, please submit your vote in advance to ensure your shares are represented at the meeting. Thank you for your continued support.

Sincerely,

|

|

||||

|

Cheryl Mayberry McKissack

Chair

|

Barry C. McCarthy

President and CEO

|

||||

|

Notice of 2023 Annual Meeting of Shareholders |

||||

We invite you to attend Deluxe Corporation's 2023 Annual Meeting of Shareholders, which will be conducted virtually. You will be able to attend the meeting, vote your shares electronically, and submit your questions during the annual meeting by visiting www.virtualshareholdermeeting.com/DLX2023 and by following the instructions in your proxy materials.

Date: Wednesday, April 26, 2023

Virtual Forum: www.virtualshareholdermeeting.com/DLX2023

Time: 3:00 p.m. CDT

Record Date: Monday, February 27, 2023

AGENDA

1.Election of nine directors to hold office until the 2024 annual meeting of shareholders;

2.Advisory vote on compensation of Named Executive Officers;

3.Advisory vote on the frequency of future advisory votes on the compensation of our Named Executive Officers;

4.Approval of Amendment No. 1 to the Deluxe Corporation 2022 Stock Incentive Plan;

5.Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

6.Take action on any other business that may properly come before the meeting and any adjournment thereof.

Shareholders of record at the close of business on February 27, 2023, are entitled to vote at the meeting and at any adjournment thereof. In this Proxy Statement, we refer to Deluxe Corporation as Deluxe, we, our, the company, or us. We are furnishing proxy materials to our shareholders over the Internet in an effort to expedite the delivery of proxy materials, reduce paper waste and save expense.

We are mailing the Notice of Internet Availability of Proxy Materials (Internet Notice) to shareholders of record beginning on or about March 13, 2023. The Internet Notice contains instructions on how to access our Proxy Statement and Annual Report, and how to vote online. In addition, the Internet Notice contains instructions on how to (i) request a paper copy of the Proxy Statement and Annual Report if you received only an Internet Notice this year, or (ii) elect to receive your Proxy Statement and Annual Report only over the Internet, if you received them by mail this year.

It is important that your shares be represented at the annual meeting. Regardless of whether you plan to attend the virtual annual meeting, please vote as soon as possible to ensure the presence of a quorum and save Deluxe further solicitation expense. You may vote your shares by telephone or the Internet, or if you received a paper proxy card, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding the methods of voting are contained in the Internet Notice and in the Proxy Statement. Voting by telephone, the Internet or mail will not limit your right to vote at or to attend the virtual annual meeting.

A replay of the virtual annual meeting will be available at www.deluxe.com through May 19, 2023.

BY ORDER OF THE BOARD OF DIRECTORS

Jeffrey L. Cotter

Chief Administrative Officer, Senior Vice President and General Counsel

March 13, 2023

| Table of Contents | |||||

|

Proxy | ||||

| summary | |||||

This summary highlights important information you will find in this Proxy Statement. As it is only a summary, please review the entire Proxy Statement carefully before you vote.

2023 Annual Meeting Information

| Date and Time: | Wednesday, April 26, 2023, at 3:00 p.m. Central Daylight Saving Time | ||||

| Place: | Online at www.virtualshareholdermeeting.com/DLX2023 | ||||

| Approximate Mail Date: | Monday, March 13, 2023 | ||||

| Record Date: | Monday, February 27, 2023 | ||||

Summary of Shareholder Voting Matters

| Agenda Item | Board's Recommendation | Page Reference | ||||||

| Election of directors | FOR EACH NOMINEE |

Page 13

|

||||||

| Advisory vote on executive compensation | FOR |

Page 54

|

||||||

| Advisory vote on frequency of future advisory votes on executive compensation | ONE YEAR |

Page 55

|

||||||

| Approval of Amendment No. 1 to the 2022 Stock Incentive Plan | FOR |

Page 56

|

||||||

| Ratification of PricewaterhouseCoopers as our independent registered public accounting firm | FOR |

Page 64

|

||||||

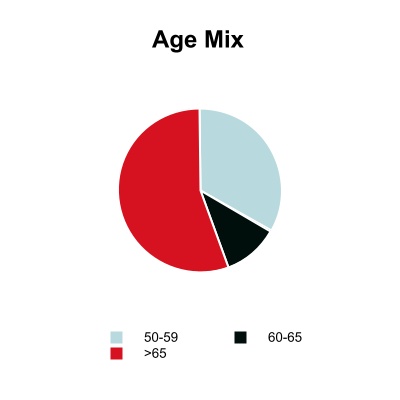

Our Director Nominees

| Name | Age | Director since | Independent | Other current public company boards | ||||||||||

| William C. Cobb | 66 | 2020 | Yes | 1 | ||||||||||

| Paul R. Garcia | 70 | 2020 | Yes | 2 | ||||||||||

| Cheryl E. Mayberry McKissack | 67 | 2000 | Yes | 0 | ||||||||||

| Barry C. McCarthy | 59 | 2018 | No | 0 | ||||||||||

| Don J. McGrath | 74 | 2007 | Yes | 0 | ||||||||||

| Thomas J. Reddin | 62 | 2014 | Yes | 2 | ||||||||||

| Martyn R. Redgrave | 70 | 2001 | Yes | 1 | ||||||||||

| John L. Stauch | 58 | 2016 | Yes | 1 | ||||||||||

| Telisa L. Yancy | 56 | 2021 | Yes | 0 | ||||||||||

1

Corporate Governance Highlights

| Diverse Board Leadership | Annual Director Elections | Annual Board and Committee Evaluation Process | ||||||||||||

| Stock Ownership Guidelines for Executive Officers and Directors | Regular Executive Sessions of Independent Directors | ESG Oversight | ||||||||||||

| No Poison Pill | Corporate Governance Guidelines | Stock Hedging and Pledging Policies | ||||||||||||

Nominee Board Composition

|

>20%

Female Representation

|

>30%

Ethnic/Racial Diversity

|

|||||||

Key Director Qualifications

| Executive leadership | Payments expertise | Public company board experience | Transformation experience | |||||||||||||||||

| Financial and accounting expertise | Management of large complex organizations | Marketing expertise | ESG expertise | |||||||||||||||||

| Risk management oversight | Technology and cybersecurity expertise | Strategic planning expertise | Digital commerce experience | |||||||||||||||||

Shareholder Outreach

As a company, we are committed to both listening and being responsive to our shareholders. Our Compensation and Talent Committee carefully considers the results of the annual shareholder vote on the compensation of our named executive officers (NEOs), commonly referred to as Say on Pay. Throughout 2022, we continued our shareholder outreach campaign to identify views on our executive compensation programs and, where reasonable, implement changes that directly address any concerns. Several of these changes are described in more detail in this Proxy Statement on pages 30-31.

During the 2022 Annual Meeting of Shareholders, approximately 83% of votes were cast in support of our executive compensation programs, compared to an average of approximately 91.5% support over the last ten years. As part of our 2022 shareholder outreach campaign, we invited our largest 25 shareholders, representing approximately 76% of our outstanding shares, to discuss their views on, among other things, executive compensation; board diversity; disclosure; and environmental, social, and governance (ESG) measures. We met with shareholders representing nearly 19% of our outstanding shares. We will continue to maintain this active dialogue with shareholders and continue to elevate and integrate feedback into board discussions, including topics such as pay-for-performance and metrics that are used to determine short- and long-term incentive compensation. The participants in the outreach

2

team consisted of our Compensation and Talent Committee Chair; Chief Human Resources Officer; Chief Administrative Officer, General Counsel and Corporate Secretary; and Vice President Total Rewards. As a part of the process, we also engaged MacKenzie Partners, Inc., as an advisor.

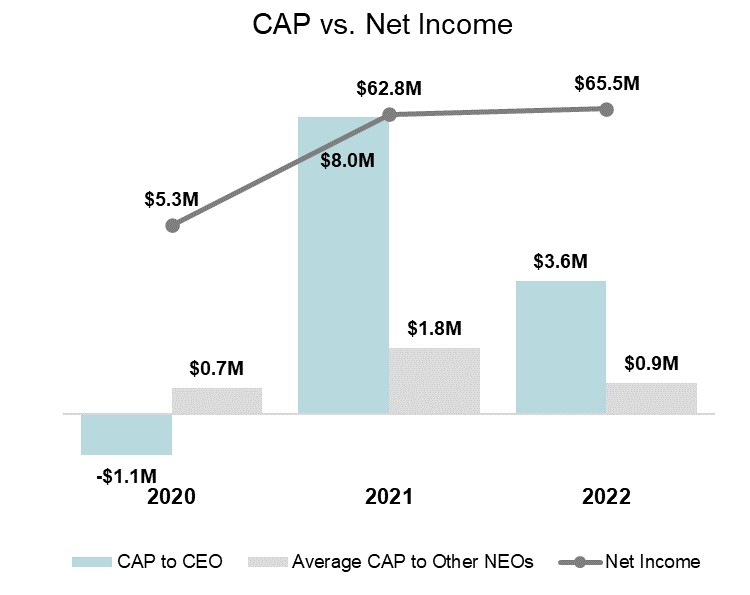

Fiscal 2022 Performance Highlights

In fiscal year 2022, we reported our second consecutive year of sales-driven growth, an achievement not seen in over a decade, inclusive of adjusted EBITDA margins of 18.7%. Sales driven growth, combined with the net full-year impact of our June 2021 acquisition of First American Payment Systems and May 2022 sale of our Australian web hosting business, resulted in revenue of $2.2 billion, an increase of 10.7% over the prior year. We reported net income of $65.5 million, compared to net income of $62.8 million for fiscal year 2021, and our adjusted EBITDA increased 2.5%, from $407.8 million in fiscal year 2021 to $418.1 million in fiscal year 2022. All four of our segments posted full-year revenue growth, primarily driven by volume and price increases. Our One Deluxe strategy continues to drive cross-selling within our customer base. While we continue to encounter macro-economic pressures, including supply chain issues, inflation, and high interest rates, we are encouraged by our continued momentum as we have transformed into a Trusted Payments and Data Company™. See Annex A for a reconciliation of adjusted EBITDA and adjusted EBITDA margin, both non-Generally Accepted Accounting Principle (GAAP) financial measures, to the most directly comparable GAAP financial measure.

Executive Compensation Summary

We have an employment agreement with Barry C. McCarthy, our President and CEO. The table below describes components of his 2022 compensation package, including 2022 compensation actions that are specific to him.

| Pay Element | Key Features | ||||

| Base Salary |

•2022 annual base salary changed April 1, 2022, from $900,000 to $925,000

|

||||

| Annual Incentive Plan |

•Target annual incentive payout for 2022 was $1,102,500, or 120% of actual base salary

•Actual annual incentive payout for 2022 was $1,323,000, or 120% of target

•Awards are paid in cash, with the option to defer into restricted stock units (RSUs), 50% of which are matched by the company, with a two-year cliff vesting schedule

|

||||

| Long-Term Equity Incentives |

•For 2022, the target value of the long-term equity incentive award was $4.5 million (a 50/50 mix of RSUs and performance share units (PSUs)), an increase from $4.0 million in 2021

|

||||

| Long-Term Disability Plan |

•Supplemental long-term disability insurance policy that restores benefits lost due to a salary cap that applies to our broad-based employee long-term disability plan, in which Mr. McCarthy also participates

|

||||

3

The table below describes the components of the 2022 compensation package for our NEOs generally.

| Element | Objectives | Key Features | ||||||

| Base Salary |

•Provides competitive pay to attract and retain experienced and successful executives with the requisite experience to drive significant growth

|

•Base salary is targeted at a blend of median comparison Peer Group data and size-adjusted median general industry survey data

|

||||||

| Annual Incentive Plan |

•Encourages and rewards valuable contributions to our annual financial and operational performance objectives

•Rewards high performance and achievement of annual corporate goals

|

•Annual incentive is targeted at a blend of median comparison Peer Group data and size-adjusted median general industry survey data

•Awarded based on the following goals: 50% enterprise/business unit adjusted revenue, 30% enterprise adjusted EBITDA, and 20% strategic initiatives, which are defined on page 35

•Awards are paid in cash, with the option to defer into RSUs, 50% of which are matched by the company, with a two-year cliff vesting schedule

•Annual incentive award targets are based on position and range from 75% to 120% of actual base salary and are capped at 200% of target value

•For 2022, target opportunity remained constant, and awards were paid out at 120% of target

|

||||||

| Long-Term Equity Incentives |

•Helps retain talent and drives stock performance for shareholders; rewards stock performance on both an absolute basis and relative to peers

•Target pay mix includes 50% PSUs, which vest based on two metrics: absolute (total revenue) and relative total shareholder return (TSR) (share price performance relative to peers in the Russell 3000, Commercial & Professional Services and Software Services GICS industries), and 50% time-based vesting RSUs

|

•Award sizes are targeted to median Peer Group levels and survey data

•RSUs accrue dividend equivalents that are only paid out upon vesting

•Metrics for the PSUs are weighted equally between three-year total revenue and three-year TSR relative to our Peer Group

•2022 awards were targeted at or near the market median and were made considering individual performance and our Peer Group and market data, as well as our President and CEO's recommendations for the other NEOs

|

||||||

| Retirement Benefits |

•Directly rewards continued service and indirectly rewards individual performance

|

•Retirement benefits include participation in 401(k) savings plans and non-qualified compensation deferral plans

|

||||||

Environmental, Social, and Governance Matters

We care deeply about our employees, our customers, our environment, and the social fabric of the communities we serve, and with the support of our board, our executive leadership team strives to build programs to further these purposes. At the management level, our ESG matters are coordinated by our Vice President, Regulatory Counsel and Chief Compliance Officer, who regularly engages with executive leadership and the board on ESG issues and who is responsible for:

•regularly assessing ESG priorities to determine the topics our stakeholders find most pressing;

•working with enterprise leadership to weave ESG-related priorities into our business operations, including sourcing and supply chain operations, human resource management, and managing our real estate portfolio; and

•managing ESG-related goals and our ESG data, measurement, and reporting.

Inclusion

Under the board’s oversight and guidance, we have taken significant actions to enhance our diverse and inclusive culture, protect and train our employees, and maintain our reputation as a great place to work. We believe that our culture of diversity, equity, and inclusion is a competitive advantage and that it enhances our ability to attract and retain talent. We continually strive to improve the attraction, retention, and advancement of diverse employees to grow and sustain talent that represents the communities in which we operate. We continue our commitment to diversity, equity, and inclusion through our sustained and targeted efforts to recruit, develop, and retain employees representing diverse groups.

Some recent examples of our commitment to diversity, equity, and inclusion include:

•33% of our directors identify as from diverse backgrounds, including the independent Chair of our board, who is a woman of color.

•In 2020, our CEO, Barry McCarthy joined the CEO Action for Diversity and Inclusion coalition. The goal of the coalition is to create and maintain environments, platforms, and forums where all employees feel comfortable reaching out to colleagues to gain greater awareness of each other’s perspectives and

4

experiences. With more than 1,000 CEOs in the coalition, work is focused on cultivating workplaces that support open dialogue on complex and difficult conversations about equality and inclusivity.

•In 2020, we formed our Employee Resource Committee and established four employee resource groups (ERGs) dedicated to fostering inclusion and diversity. Since 2020, we have grown our programs and now offer eight ERGs, including for our African American; Pacific Islander, Middle Eastern, Asian; disabled; Hispanic and Latino; veteran; LBGTQI+; parent; and female employee populations. Each group has a senior management-level leader who champions its cause and offers support. Since 2020, our ERGs have provided over 100 hours of programming, and hundreds of our employees regularly participate in ERG meetings and activities.

•Since 2020, we have recognized Rev. Dr. Martin Luther King, Jr. Day, Juneteenth, and Veterans Day as company-wide holidays.

•Beginning in 2021, we added diversity to our formal strategic initiatives. As part of this commitment, we began including diversity measures in our Annual Incentive Plan.

•In 2020, we and our Deluxe Corporation Foundation (Foundation) partnered with the National Urban League and awarded a grant of $500,000 to be paid over three years. A one-year extension and additional $200,000 grant was approved in 2022 to be paid in 2023. Additionally, our leadership continues to work with the National Urban League to create targeted volunteer opportunities nationally to leverage our employees’ talents to support racial justice and equality.

•Since 2020, our Women’s ERG has hosted an annual “Unlocking Your Potential” conference, offering a free event targeted at women, but open for anyone looking to learn, grow, and get inspired through sessions ranging from resilience and wellbeing to inclusion and diversity.

•In 2022, we were named to the Honor Roll as part of St. Catherine University’s annual report of The Minnesota Census of Women in Corporate Leadership. We have been included on this list each year since the inception of the award in 2008.

•In 2022, we earned the honor of becoming a Yellow Ribbon Company, a designation awarded by the state of Minnesota to those companies meeting the top criteria for supporting veterans and their families.

•In 2022, we earned a top score of 100 on the Disability Equality Index and were named a “Best Place to Work for Disability Inclusion” for the third year in a row.

•In 2022, The Human Rights Campaign Foundation’s Corporate Equality Index recognized our company as a Best Place To Work For LGBTQ+ Equality.

Employee Well-being

Well-being in our organization is about having a holistic commitment to provide resources and support for our employees so that they can deliver for customers and shareholders. We listen to our employees and we heard them when they asked for more help. Because of this, we increased our offering of programs to benefit our employees and support work environments that encourage growth, innovation, and productivity. As the world went online in 2020, medicine did too. Starting in 2022, our employees and eligible dependents enrolled in our medical plans all have access to telemedicine providers as part of those plans. In addition to telemedicine, our medical benefits include paying up to $10,000 for covered individuals to travel for plan-covered medical care not available near their homes. Other of our benefits include paid parental leave and infertility, adoption, and surrogacy assistance. We also partnered with Care.com to offer services for employees to find tutors, nannies, children’s daycare, and eldercare, allowing employees to have access to back-up day care days for children, adults, and pets, expert assistance in finding care, and free on-demand tutoring for grades K-12 plus college. Through our W.R. Hotchkiss Foundation, we provide $1 million each year in scholarships for the dependents of our employees to continue their education in college or vocational programs. We offer an Employee Assistance Program through Magellan Health that offers employees and their household members free confidential counseling on issues such as managing stress, parenting, coping with grief, and working through life changes. We also offer employees tuition assistance and travel assistance, and qualified long-term employees have the opportunity to take a sabbatical. Beginning in 2023, we will be offering unlimited flexible time off to our salaried employees. With our team of human resources business partners, we want to know how our employees feel. By enabling our employees to thrive in their personal lives, we provide tools for our employees to best deliver for customers and shareholders while at work.

Investing in our Communities

Our partnerships and charitable work in the communities we serve are an integral part of our core values. This spirit of community is felt throughout our organization and is fostered by our paid volunteer time off (VTO) program for employees, which provides three paid VTO days per year. It is also reflected in our partnership with our Foundation,

5

which enables employees, retirees, and our board members to donate to eligible non-profit organizations and receive a matching donation, dollar for dollar, up to a maximum $2,000 per person, per year. Our commitments go far beyond monetary donations. Several of our top executives serve on boards for major not-for-profit organizations and other community organizations that align with our company values on diversity initiatives, rebuilding communities, and education. We also encourage our employees to become involved in their communities.

We continue our commitment to enriching our communities in the following ways:

•Since 1992, we have partnered with Junior Achievement chapters in our local communities to inspire and prepare young people to succeed. Junior Achievement provides school-aged children with lessons in financial literacy, work and career readiness, and entrepreneurship. We support Junior Achievement’s mission through Foundation grants, awareness, and employee volunteers. Hundreds of our employees have volunteered in local classrooms to make a profound difference to the youth in our communities.

•We have partnered with the American Red Cross for decades, organizing blood drives at our locations and hosting fundraisers and bake sales to help fund the American Red Cross to continue its mission of preventing and alleviating human suffering in the face of emergencies.

•The sixth season of our original series, “Small Business Revolution,” was nominated for a Daytime Emmy Award for Outstanding Lifestyle Series; at the time, the only show on Hulu to be nominated for a Daytime Emmy. Season six was especially important, as we brought the show home to Minneapolis and St. Paul, Minnesota, celebrating and sharing the stories of Black-owned business and entrepreneurs in our local communities.

•In 2022, in partnership with Habitat for Humanity, we helped build new homes across the country, including inviting our technology partners to join us on a two-day build in Chaska, Minnesota.

•For Black History Month in 2022, we partnered with the Minnesota Timberwolves and Minnesota Lynx to film an original YouTube series called “The Come Up,” that focused on highlighting the significance of Black excellence and the importance of uplifting the Black community. This partnership, working with the Black Men’s Success Initiative, also included hosting a career development training camp designed to educate, inspire, and empower BIPOC and other historically marginalized youth and young adults.

•Through our annual Employee Giving Campaign, employees pledged $132,000 in donations to eligible non-profit organizations, such donations to be made in 2023 via credit card or payroll deductions.

•Through our Foundation, in 2020, we partnered with Minnesota’s Metropolitan Economic Development Association (MEDA) and awarded a grant of $300,000 to be paid over three years. A one-year extension and an additional $100,000 grant was approved in 2022, to be paid in 2023. Our leadership continues to work with MEDA to help advance its mission of helping BIPOC entrepreneurs succeed.

•Through our Foundation, we partnered with the National Center for Civil and Human Rights, an Atlanta-based museum and human rights organization that promotes critical thinking and community engagement, and awarded a grant of $300,000 to be paid over three years. A one-year extension and additional $100,000 grant was approved in 2022, to be paid in 2023. Notably, the National Center for Civil and Human rights partners with the Auschwitz Institute for the Prevention of Genocide and Mass Atrocities to develop and provide a human rights-centric training program for law enforcement leadership and officers.

•In 2022, our employees contributed more than 22,500 hours to our local communities through our VTO program, which allows employees to get paid for the time they spend volunteering with non-profit organizations that align with their values. Notably, our employees contributed more than 2,000 hours during National Service Week alone.

•Each member of our communities is important to us, including those applying to work on our teams. In 2022, we were awarded the Talent Board Candidate Experience Award for the tenth consecutive year, celebrating our commitment to improving, elevating, and promoting quality candidate experiences during our hiring process.

Human Rights and Sourcing

We are aligned with the UN Guiding Principles on Business and Human Rights and our Code of Ethics, Supplier Code of Ethics, and Slavery and Human Trafficking Statement set standards for our company, suppliers, and partners regarding our expectations around the protection of human rights. Our supplier base is large and complex, with hundreds of suppliers in more than 20 countries, and we embrace a Supplier Code of Conduct that allows us to mitigate risk and hold our suppliers accountable for human rights standards. We expect all suppliers to uphold our

6

Supplier Code of Conduct, and we enforce that code through our supplier audits and business decisions. Consistent with the rights we set forth in our Code of Conduct and our Supplier Code of Conduct, we

•prohibit forced labor and child labor;

•prohibit discrimination;

•maintain safe and healthy working conditions;

•seek to compensate employees fairly and in compliance with applicable wage, work hours, working conditions, overtime, sick time, and benefits laws; and

•respect the principles of freedom of associate and collective bargaining.

Trust, Security and Privacy

For over 100 years, Deluxe has been trusted partner to organizations of all sizes, and we take this responsibility seriously. Our robust privacy and information security practices, policies, and controls help us ensure privacy and data security for our customers and shareholders. We have enterprise risk-based data privacy and cybersecurity programs dedicated to protecting our employee, customer, and partner data and other sensitive information. Our privacy policies, together with associated controls and procedures, provide a comprehensive framework to inform and guide the handling of data. These programs dovetail with our information security program in a manner designed to ensure that any data we handle remains protected. We employ an in-depth, defensive strategy, utilizing the concept of security layers and the CIA (confidential, integrity and availability) triad model. We have an enterprise risk management committee to oversee and advise on key risk areas of our organization. In the event a cybersecurity incident is identified, our Cybersecurity Incident Response team will act in accordance with our Incident and Crisis Management Program.

While every one of our employees plays a part in information security and data privacy, oversight responsibility is shared by our board and management:

•The board has primary oversight responsibility for information security, cybersecurity, and data privacy within our company’s overall risks.

•Members of management, including our Chief Technology and Digital Officer, Chief Information Security Officer and Chief Compliance Officer, along with senior members of our information security and compliance and privacy and legal teams, are responsible for identifying and managing risks related to these topics and reporting those risks and mitigation strategies to the board.

Our programs and practices for these areas include the following:

•Management provides regular updates to the board.

•We protect Deluxe through our systems and processes. Using a combination of vendor and in-house technology, we operate a threat intelligence program that is well-positioned to identify and assess risk as well as investigate and respond to cyber threats presented to the organization.

•Our employees are regularly trained and tested on information security principles and processes. This includes annual training as well as ongoing practice and education to help employees identify suspicious activity and report it to the proper channels.

Sustainability

We care about sustainability and strive to factor it into everything we do. Protecting the environment and our shared future is key to our business and to delivering the products our customers need. Oversight of sustainability and our environmental stewardship practices resides with our board. Paper is the raw material we use the most in our manufacturing process. We source more than 90% of our paper from Forest Stewardship Council (FSC)-certified paper mills. FCS’s standards expand protection of water quality, prohibit harvesting from rare old-growth forests, prevent the loss of natural forest cover, and prohibit the use of hazardous pesticides. Additionally, the vast majority of the products we produce are made from paper, allowing us to collect and recycle applicable production waste and paper trim and also allowing our customers to recycle our products back into the paper lifecycle.

We are proud that two of our facilities are certified through the Leadership in Energy and Environmental Design (LEED), a program used worldwide and developed by the U.S. Green Building Council to rate the design, construction, operation, and maintenance of green buildings. Our New York City facility is a LEED-certified gold building and our Minneapolis facility is a LEED-certified silver building.

In 2007, we embarked on a continuous effort to retrofit many of our facilities with more energy efficient options, including installing an energy-saving white roof on our Kansas City facility and building our new office spaces in

7

Atlanta and Minneapolis with LED lighting, daylight harvesting strategies, and optimized HVAC systems. In addition, we have pivoted from using custom inks in our manufacturing processes, instead using ink mixing systems which, along with the installation of digital presses, have reduced the time, energy, ink, paper, and waste required to provide our products to our customers.

Ethics and Compliance

For over 100 years, we have operated with a focus on our values. Through our steadfast commitment to "doing well by doing right," we display ethical behaviors every day that allow us to put our customers first, maintain confidentiality, sell responsibly, make good choices, respect one another, maintain a safe and healthy workplace, celebrate inclusion, diversity, and equity, respect human rights, compete fairly, avoid conflicts of interest, avoid bribery and corruption, follow trade laws, protect private information, ensure financial integrity, avoid insider trading, and communicate responsibly. We take reports of suspected violations of our Code of Ethics seriously. There are several reporting channels available to our employees beyond the standard management chain, including a private email address, a reporting hotline, and a website. The hotline and website reporting systems allow for anonymous reporting. Each report is documented and investigated, and our board reviews reporting trends and patterns every quarter. Every year our employees receive formal ethics and compliance training to ensure we all know and understand our responsibilities so that we can deliver for shareholders. In addition to annual training, employees receive monthly compliance and ethics newsletters and reminders, as well as quarterly updates on new laws and regulations. Additionally, our anti-corruption program includes annual employee training and reference materials. Finally, we assess our third-party suppliers for anti-corruption risk as part of our standard third party risk management program.

8

Meeting and Voting Information

What is the purpose of the annual meeting?

At our annual meeting, the board will ask shareholders to vote on the matters disclosed in the Notice of Annual Meeting of Shareholders. We will also consider any other business that may be properly presented at the meeting (although we are not expecting any other matters to be presented).

How can I attend the meeting?

You can attend the meeting online by logging on our virtual forum at www.virtualshareholdermeeting.com/DLX2023 and following the instructions provided on your proxy card, voter instruction card or Internet Notice.

To participate in the annual meeting, you will need the 16-digit control number included on your proxy card, voter instruction card or Internet Notice. If you do not have this control number at the time of the meeting, you will still be able to attend as a guest, but you will not be able to vote or ask questions.

Why is Deluxe holding a virtual annual meeting?

We are holding a virtual meeting again this year because we believe a virtual meeting provides ease of access, real-time communication, and cost savings for our shareholders and the company, and facilitates shareholder attendance and participation from any location.

How will the meeting be conducted?

The meeting will be conducted online, in a fashion similar to an in-person meeting. You will be able to attend the meeting online, vote your shares electronically, and submit your questions during the meeting by visiting our virtual forum at www.virtualshareholdermeeting.com/DLX2023 and following the instructions on your proxy card, voter instruction card or Internet Notice. The meeting will begin promptly at 3:00 p.m. CDT. We encourage you to access the meeting prior to the start time. Online check-in will begin at 2:30 p.m. CDT, and you should allow ample time for the check-in procedures.

How can I ask questions during the meeting?

You may submit questions in real time during the meeting through the virtual forum. We are committed to acknowledging each appropriate question we receive in the order that it was received, with a limit of one question per shareholder until we have allowed each shareholder to ask a question. We will allot approximately 15 minutes for questions during the meeting. Submitted questions should follow our Rules of Conduct in order to be addressed during the meeting. Our Rules of Conduct will be posted on the forum. Answers to appropriate questions not addressed during the meeting will be posted following the meeting on the investor relations page of our website.

What can I do if I need technical assistance during the meeting?

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual forum log-in page.

If I can’t attend the meeting, how do I vote or listen to it later?

You do not need to attend the virtual meeting to vote if you submitted your vote via proxy in advance of the meeting. A replay of the meeting, including the questions answered during the meeting, will be available on www.deluxe.com through May 19, 2023.

Who is entitled to vote at the meeting?

The board has set February 27, 2023, as the record date for the meeting. If you were a shareholder of record at the close of business on February 27, 2023, you are entitled to vote at the meeting. You have one vote for each share of common stock you held on the record date. Cumulative voting for the election of directors is not permitted. As of the record date, 43,376,792 shares of our common stock were outstanding. We do not have any other class of capital stock outstanding.

9

How many shares must be present to hold the meeting?

A quorum is necessary to hold the meeting and conduct business. The presence of shareholders who can direct the vote of at least a majority of the outstanding shares of common stock as of the record date is considered a quorum. A shareholder is counted present at the meeting if the shareholder (1) is present and votes at the virtual meeting, or (2) has properly submitted a proxy or voted by telephone or the Internet. If you vote "WITHHOLD" or "ABSTAIN," your shares will still be counted as present at the meeting for the purposes of determining a quorum.

What is the difference between a shareholder of record and a "street name" holder?

If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered the shareholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank, trustee, or other nominee, you are still considered the beneficial owner of the shares, but your shares are deemed to be held in "street name."

Who pays the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the charges and expenses of brokerage firms or other nominees for forwarding proxy materials to beneficial owners. We are soliciting proxies primarily by use of the Internet. In addition, our directors, officers, and employees may solicit proxies personally or by email, mail, or telephone. These individuals receive no additional compensation for these services.

How many votes are required to approve each item, and how does the Board recommend that I vote?

| Proposals | Votes Required | Voting Options | Board Recommendation |

Broker Discretionary Voting Allowed 1

|

Effect of Withhold Vote/ Abstention |

Effect of Broker Non-Vote 1

|

||||||||||||||

Item 1. Election of the nine directors listed in this Proxy Statement |

Plurality of the votes present and entitled to vote on this item 2

|

For or withhold | "FOR" each director nominee | No | Directors who receive more "WITHHOLD" votes than "FOR" votes must tender their resignation | None | ||||||||||||||

Item 2. Advisory vote to approve compensation of our Named Executive Officers

|

Majority of votes present and entitled to vote on this item 3

|

For, against or abstain | "FOR" | No | Same as an "AGAINST" vote |

None | ||||||||||||||

Item 3. Advisory vote on the frequency of future advisory votes on compensation of our Named Executive Officers

|

Majority of votes present and entitled to vote on this item 3

|

One, two, or three years, or abstain | "ONE YEAR" | No | Same as an "AGAINST" vote | None | ||||||||||||||

Item 4. Approval of Amendment No. 1 to the Deluxe Corporation 2022 Stock Incentive Plan

|

Majority of votes present and entitled to vote on this item 3

|

For, against or abstain | "FOR" | No | Same as an "AGAINST" vote | None | ||||||||||||||

Item 5. Ratification of the appointment of PricewaterhouseCoopers LLP as Deluxe’s independent registered public accounting firm for the fiscal year ending December 31, 2023

|

Majority of votes present and entitled to vote on this item 3

|

For, against or abstain |

"FOR" | Yes | Same as an "AGAINST" vote | Not applicable |

||||||||||||||

(1)If you are a beneficial owner but not the record holder, you generally cannot vote your shares directly and must instead instruct your broker, trustee, bank or nominee how to vote your shares using the voting instruction form provided by that intermediary party. If you do not provide voting instructions, whether your shares can be voted by this party depends on the type of matter being considered. If this party does not have discretion to vote your shares, your shares will not be voted unless you provide instructions. Broker non-votes will generally have no effect in determining whether any proposals to be voted on at the meeting are approved.

(2)A plurality means that the nine nominees receiving the most votes will be elected. In an uncontested election of directors, our Corporate Governance Guidelines require that if an incumbent director receives more "WITHHOLD" votes than "FOR" votes in this type of an election, that director nominee must tender his or her resignation to the board following the certification of the shareholder vote. The Corporate Governance Committee must then make recommendations to the board as to whether to accept the letter of resignation, and the board must take action with respect to this recommendation and disclose its decision-making process.

(3)This amount must be a least a majority of the minimum number of shares entitled to vote that would constitute a quorum. "Shares present" includes shares represented by attendance or by proxy at the virtual annual meeting.

10

How do I vote my shares?

We are mailing the Internet Notice on or about March 13, 2023 to shareholders of record. If your shares are held in street name, your broker or other agent is responsible for sending you an Internet Notice. You will not receive a printed copy of these proxy materials unless you request to receive these materials in hard copy by following the instructions provided in the Internet Notice. Instead, the Internet Notice will instruct you how to access and review all the important information contained in these proxy materials, and how to vote. If you received an Internet Notice by mail and would like to receive a printed copy of these proxy materials, you should follow the instructions for requesting such materials included in the Internet Notice.

Voting Methods | ||||||||

| Step-by-Step Instructions | Voting Deadline | |||||||

Internet

|

Instructions can be found on the Internet Notice. The Internet procedures are designed to (1) verify your identity, (2) provide voting instructions, and (3) confirm those voting instructions have been properly recorded

•Go to www.proxyvote.com

•You will need the 16-digit control number on your Internet Notice, proxy card or voter instruction card

|

•11:59 p.m. EDT on April 25, 2023

•Internet voting is available 24 hours a day

|

||||||

Telephone

|

The telephone procedures are designed to (1) verify your identity, (2) provide voting instructions, and (3) confirm those voting instructions have been properly recorded

•Call 800-690-6903 (toll-free)

•You will need the 16-digit control number on your Internet Notice, proxy card or voter instruction card

|

•11:59 p.m. EDT on April 25, 2023 Telephone voting is available 24 hours a day

|

||||||

Mail 1

|

You own your shares directly:

•Complete, sign, and date the proxy card

•Mail it in the pre-addressed envelope that accompanies the proxy card

You own your shares in street name:

•Request a voting instruction card according to the instructions on the Internet Notice provided to you by your broker or other agent

•Complete, sign, and date the voting instruction card provided by the broker or other agent

•Mail the voting instruction card in the pre-addressed envelope provided

|

•Directly-Held Shares: Proxy cards must be received before April 26, 2023 (date of the annual meeting) in order for the shares to be timely voted

•Shares Held in Street Name: Voting instruction cards must be received before the date specified on the voting instruction card in order for the shares to be timely voted

|

||||||

At the virtual meeting

|

If you attend the virtual meeting, you will be able to vote online at www.virtualshareholdermeeting.com/DLX2023 |

•April 26, 2023 until the voting polls are announced closed

|

||||||

(1)This option is only available to shareholders who receive a paper proxy card or receive a voting instruction card.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

It means you hold shares registered in more than one account. To ensure that all of your shares are voted, if you vote by telephone or the Internet, vote once for each Internet Notice you receive. If you wish to consolidate your accounts, please contact our stock transfer agent, EQ Shareowner Services at P.O. Box 64874, St. Paul, MN 55164 or by toll-free telephone at (800) 401-1957. You also may receive a "voting instruction" card, which looks very similar to a proxy card. Voting instructions are prepared by brokers, trustees, banks or nominees for shareholders who hold shares in street name.

What if I submit my proxy but do not specify how I want my shares voted?

If you vote your shares directly (as opposed to voting through a broker or other intermediary) and do not specify on your proxy card (or when giving your proxy by telephone or the Internet) how you want to vote your shares, the proxy holder will vote them as the board recommends as outlined above.

11

Can I change my vote?

Yes. If you attend the virtual meeting, whether you are a shareholder of record or hold your shares in street name, you may change your vote online during the meeting (attendance will not, by itself, revoke a proxy). If you are a shareholder of record, you can change your vote and revoke your proxy at any time before it is voted at the meeting in any of the following ways:

•by sending a written notice of revocation of your proxy to our Corporate Secretary;

•by submitting another properly signed proxy card at a later date to our Corporate Secretary; or

•by submitting another proxy by telephone or the Internet at a later date.

If you hold your shares in street name, you must follow the voting instructions provided to you by your broker, trustee, bank or nominee.

12

ITEM 1: ELECTION OF DIRECTORS

Nominees for Election

There are currently nine individuals serving on our board. Each director's term expires as of the date of the annual meeting of shareholders. The board recommends that the nine individuals presented on the following pages, all of whom are current directors, be elected to serve on the board until the 2024 annual meeting of shareholders. With the exception of Mr. McCarthy, who serves as our President and CEO and therefore is not independent, all nominees have been determined by the board to meet the independence standards of the New York Stock Exchange (NYSE) (see the discussion of Director Independence in the "Board Structure and Governance" section of this Proxy Statement). Each of the individuals listed below has consented to being named as a nominee in this Proxy Statement and has indicated a willingness to serve if elected. However, if any nominee becomes unable to serve before the election, the shares represented by proxies may be voted for a substitute designated by the board, unless a contrary instruction is indicated in the proxy card.

Pursuant to our Corporate Governance Guidelines, at any shareholder meeting at which directors are subject to an uncontested election (i.e., an election where the only nominees are those recommended by the board), any nominee for director who receives a greater number of "WITHHOLD" votes from his or her election than "FOR" votes shall submit to the board, within five (5) business days of certification of the shareholder vote by the Inspector of Elections, a written offer to resign from the board. The Corporate Governance Committee shall promptly consider the resignation offer and recommend to the full board whether to accept it. The board will act on the Corporate Governance Committee’s recommendation within 90 days following the certification of the shareholder vote by the Inspector of Elections, which action may include, without limitation, acceptance of the offer of resignation, adoption of measures intended to address the perceived issues underlying the vote, or rejection of the resignation offer. Thereafter, the board will disclose its decision whether to accept the director’s resignation offer and the reasons for rejecting the offer, if applicable, in a Current Report on Form 8-K to be filed with the United States Securities and Exchange Commission (SEC) within four business days after the board’s determination.

The board recommends that you vote "FOR" the election of each of the following nominees:

William C. Cobb

Chairman and CEO, Frontdoor, Inc.

Director since: 2020

Age: 66

Independent: Yes

|

Background

•Chief Executive Officer (since June 2022), director, and Chairman (since 2018) of Frontdoor, Inc., a provider of home service plans (Nasdaq: FTDR)

•Served as President and Chief Executive Officer of H&R Block, Inc. from 2011 to 2017, where he was also a director

•Held various leadership positions at eBay Inc., including President, eBay North America Marketplaces

•Served in various senior sales and marketing positions with PepsiCo, Inc.

Qualifications

•Extensive background in marketing, technology, and digital commerce, which will assist us as we continue to transform our company, particularly in the areas of Data Solutions

•As a public-company CEO at Frontdoor and H&R Block, he has dealt with a broad range of human capital management, environmental, and social issues, and assumed responsibility for enterprise risk management

•His history of service on public company boards, as well as his executive leadership roles with Frontdoor, H&R Block, eBay and PepsiCo, make him uniquely qualified to advise on an array of matters facing public companies

Committees: Audit; Finance (Chair)

|

||||

Paul R. Garcia

Retired Chairman and CEO, Global Payments Inc.

Director since: 2020

Age: 70

Independent: Yes

|

Background

•Retired Chairman and Chief Executive Officer of Global Payments Inc., a publicly traded, leading provider of credit card processing, check authorization and other electronic payment processing services, from 2001 to 2014

•Former President and CEO of NaBanco, an electronic credit card processor

Qualifications

•As a pioneer in the financial services industry, he has extensive experience in the payments space, which is one of our major strategic areas of focus

•Currently serves on the boards of directors of Repay Holdings Corporation (Nasdaq: RPAY) and United Health Group (NYSE: UNH)

Committees: Compensation and Talent (Chair); Finance

|

||||

13

Cheryl E. Mayberry McKissack

CEO of Nia Enterprises LLC

Director since: 2000

Independent Chair

since: 2019

Age: 67

Independent: Yes

|

Background

•Independent Chair of Deluxe since 2019

•Chief Executive Officer (2000-present) of Nia Enterprises LLC, a Chicago-based marketing, entrepreneurial business and digital consulting firm, and President, Board Member and co-owner of privately held Black Opal Inc., a cosmetics and skin care firm consisting of two brands, Black Opal and Fashion Fair cosmetics, co-owned under Nia Enterprises. LLC

•CEO of Ebony Media Operations LLC (May 2016-March 2017), a print and media company

•COO of Johnson Publishing Company (JPC) and President of its affiliate, JPC Digital (2013-2016)

•Provided project support to JPC under a consulting relationship between Nia Enterprises and JPC prior to her appointment as COO and President of JPC Digital, including launching the ebony.com website and several other transformational digital and business projects

•Served as the Worldwide Senior Vice President and General Manager for Open Port Technology and was Vice President for the Americas and a founding member of the Network Systems Division for 3Com (formerly U.S. Robotics)

Qualifications

•Regarded as an expert on entrepreneurship and the art of selling; author of the book, The Entrepreneurial Sell, published in 2018

•Associate Adjunct Professor of Entrepreneurship at the Kellogg School of Business, Northwestern University, where she lectured for 10 years (2005-2015)

•As a successful entrepreneur and digital technology executive, brings a unique perspective to the board

•Given that two of our segments are Data Solutions and Promotional Solutions, her experience in SaaS marketing and new media solutions is a valuable complement to the skills she brings to the board as a small business owner and former executive of several technology and new business ventures

Committees: Compensation and Talent; Corporate Governance

|

||||

Barry C. McCarthy

President and CEO of Deluxe Corporation

Director since: 2018

Age: 59

Independent: No

|

Background

•President and CEO of Deluxe Corporation since 2018

•Served in various senior executive positions during the previous 14 years, most recently, from 2014 to 2018, as Executive Vice President and Head of Network and Security Solutions, a $1.5 billion publicly reported segment of First Data Corporation, a financial services company since acquired by Fiserv Inc.

Qualifications

•Sole member of our management represented on the board

•Leads the development and execution of our strategies by drawing on his strong background in product development, sales, marketing, and technology innovation

•Significant experience leading corporate transformations

•Accomplished executive and financial technology leader with an extensive track record of developing and building innovative, tech-enabled solutions

Committees: None

|

||||

Don J. McGrath

Managing Partner of Diamond Bear Partners LLC

Director since: 2007

Age: 74

Independent: Yes

|

Background

•Managing Partner and co-founder of Diamond Bear Partners LLC, an investment company, since 2009

•Chairman and CEO (2005-2009) and President and COO (1998-2004) of BancWest Corporation, a $75 billion bank holding company serving nearly three million households and businesses

•Director of BancWest (1998-2010)

•Served as Chairman of the Board of Bank of the West (a BancWest subsidiary) and as CEO (1996-2007)

•Appointed to the President's Council on Financial Literacy in 2008

Qualifications

•40 years of experience in the banking and financial services industry, particularly in the large bank sector, enables him to provide us with valuable insight into this important portion of our customer base

•Led BancWest through an era of significant growth and therefore is well-suited for our board as we continue to execute our transformational growth strategies

Committees: Audit; Corporate Governance (Chair)

|

||||

14

Thomas J. Reddin

Managing Partner of Red Dog Ventures LLC

Director since: 2014

Age: 62

Independent: Yes

|

Background

•Principal of Red Dog Ventures LLC, a venture capital and advisory firm for early stage digital companies, which he founded in 2007, and of which he has been the Managing Partner since 2009

•Served as the Chief Executive Officer (2008-2009) of Richard Petty Motorsports

•Chief Marketing Officer (1999-2000); President and Chief Operating Officer (2000-2005); and Chief Executive Officer (2005-2007) of LendingTree.com, an online lending exchange

Qualifications

•17 years of experience in the consumer goods industry, including 12 years at Kraft General Foods and five years at Coca-Cola USA, where he managed the Coca-Cola® brand as Vice President of Consumer Marketing and played a lead role in the introduction of bottled water in the U.S. market

•Brings a wealth of experience in data and data analytics, digital marketing, e-commerce, and product management, all of which are central to our growth strategy

•His extensive leadership experience, including serving on multiple public company boards and audit, compensation, nominating, and governance committees, further qualify him for his role as a member of the board

•Currently serves on the boards of directors of Asbury Automotive Group, Inc. (NYSE: ABG), where he serves as Chair of the Board, Tanger Factory Outlet Centers, Inc. (NYSE: SKT), where he serves as Chair of the Compensation Committee, and previously served on the boards of Premier Farnell PLC, Valassis Communications, Inc. and R.H. Donnelley Corporation

Committees: Compensation and Talent; Finance

|

||||

Martyn R. Redgrave

Managing Partner and CEO of Agate Creek Partners LLC

Director since: 2001

Age: 70

Independent: Yes

|

Background

•Managing Partner and CEO of Agate Creek Partners LLC, a professional governance and consulting services company co-founded by Mr. Redgrave in 2014

•Executive Vice President and Chief Administration Officer (2005-2012), Chief Financial Officer (2006-2007), and Senior Advisor (2012-2014) to L Brands, Inc. (formerly known as Limited Brands, Inc.), one of the world’s leading personal care, beauty, intimate apparel and specialty apparel retailers

Qualifications

•Served as Independent Chairman of our board (2012-2019)

•In addition to bringing extensive operations management experience and financial and accounting acumen to the board, his background in overseeing the reporting systems and controls of complex business operations is particularly relevant to the work of our board

•Throughout his career, has had direct involvement with matters similar to those encountered by our company, such as operations management, financial reporting and controls, enterprise risk management, information technology systems, data management and protection, and access to capital markets

•His background also includes mergers and acquisitions and financial analysis, continuing areas of importance for us

•Currently serves on the Board of Directors of Igniting Consumer Growth Acquisition Company Limited, a special purpose acquisition company focused on consumer facing companies

•Served on the Boards of Directors of Francesca's Holdings Corporation (2015-2021) and Popeye's Louisiana Kitchen, Inc. (2013-2017, when the company was sold)

Committees: Finance; Corporate Governance

|

||||

John L. Stauch

President and CEO of Pentair plc

Director since: 2016

Age: 58

Independent: Yes

|

Background

•Since 2018, President and Chief Executive Officer and a director of Pentair plc (NYSE: PNR), a leading water treatment company; served as Pentair's Executive Vice President and Chief Financial Officer from 2007-2018

•Chief Financial Officer of the Automation and Control Systems unit (2005-2007) of Honeywell International, Inc.

•Served as Chief Financial Officer and Information Technology Director of PerkinElmer Optoelectronics and various executive, investor relations and managerial finance positions within Honeywell International, Inc. and its predecessor AlliedSignal, Inc. (1994-2005)

Qualifications

•His role as President and CEO of Pentair plc, and his prior service as CFO of Pentair for 11 years, renders him a financial expert, and he has extensive direct experience with many aspects of public company strategy and operations

Committees: Audit (Chair); Finance

|

||||

15

Telisa L. Yancy

President, Direct to Consumer, American Family Insurance

Director since: 2021

Age: 56

Independent: Yes

|

Background

•Group President of American Family Insurance since January 2023

•Previous positions at American Family include serving as President, Direct to Consumer from 2021 to 2023, Chief Operating Officer Agency Business from 2019 to 2021, and Chief Marketing Officer from 2015 to 2019

•Held general management, sales, marketing and operations leadership positions in a variety of industries

Qualifications

•Her background in understanding customers, products, and digital ecosystems provides guidance as we continue to transform our business and encourage cross-selling of products and services across our segments

•Her operations leadership experience allows her to advise on customer service, operations, marketing, technology, and sales initiatives

•Currently serves as a director for National Public Radio and the American Property and Casualty Insurance Association

Committees: Audit; Compensation and Talent

|

||||

Director Skills, Experience, Background and Tenure

We operate in highly competitive markets characterized by rapidly evolving technologies and exposure to business cycles. Along with our board, our Corporate Governance Committee is responsible for assessing the appropriate skills, experience, and background that we seek in board members in the context of our business and the existing composition of our board. This assessment includes numerous factors, including, but not limited to, the following:

•independence;

•relevant skills and expertise; and

•diversity of background and experience.

Our board determines whether a nominee's background, experience, personal characteristics, and skills will advance the goal of creating and sustaining a board that can support and oversee our company's complex activities. Our board is committed to actively seeking superior, diverse director candidates for consideration and invites candidates to self-identify diversity in their background, including gender, sexual orientation, race or ethnicity, as well as diversity in their work experiences. As set forth in our Corporate Governance Guidelines, the committee and the board periodically review and assess the effectiveness of the practices used in considering potential director candidates. Following this process has ensured that our board is comprised of experienced leaders with a combination of the skills and business expertise necessary to provide appropriate oversight, critical viewpoints and guidance to a transforming business.

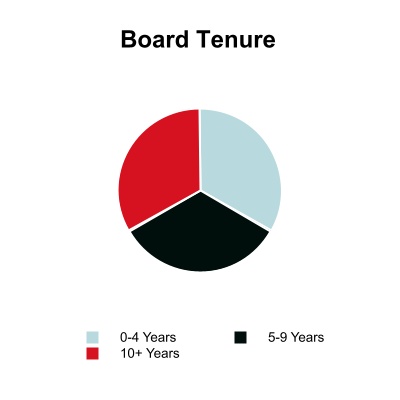

If all of the nominees are elected to the board, after the 2023 annual meeting of shareholders, our directors will have served an average of approximately ten years on the board, ranging from less than two years to 23 years of board service. This mix of tenure on the board is intended to support the view that the board as a whole represents a "portfolio" of new perspectives and deep institutional knowledge.

16

BOARD STRUCTURE AND GOVERNANCE

Corporate Governance at Deluxe

We understand that corporate governance practices change and evolve over time, and we seek to adopt and use practices that we believe will be of value to our shareholders and will positively aid in the governance of our company. Below is a summary of our governance practices.

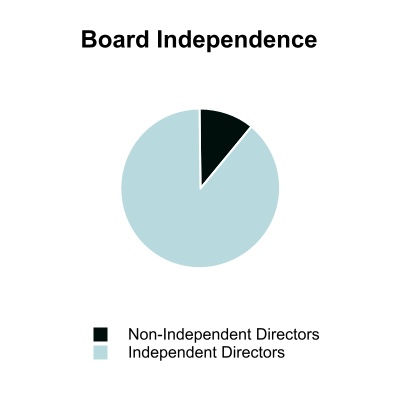

| Independent Board |

•Eight of our nine director nominees are independent

|

||||

| Board Diversity |

•Two of our director nominees self-identify as African-American, one as Hispanic, and two are female

|

||||

| Independent Chair of the Board |

•Acts as a liaison between management and the board

•Provides independent advice and counsel to the President and CEO

•In concert with the President and CEO, develops and sets the agenda for meetings of the board and annual meetings of shareholders

•Calls special meetings of the board when appropriate

•Ensures that the independent directors hold executive sessions and presides over these sessions

|

||||

| Annual President and CEO Evaluation and Succession Planning |

•The board annually evaluates the President and CEO's performance

•The board annually conducts a rigorous review and assessment of the succession planning process for the President and CEO and other executive officers

|

||||

| Annual Director Election and Outside Board Service |

•Each director is elected on an annual basis

•Currently, no director serves on more than two other public company boards, and our President and CEO does not serve on any other public company boards

|

||||

| Director Stock Ownership |

•Within five years after initial appointment or election to the board, each independent director is required to own our common stock with a market value of at least five times the director's annual cash retainer

|

||||

| Stock Hedging and Pledging Policies |

•Our insider trading policy bars our directors and executive officers from owning financial instruments or participating in investment strategies that hedge the economic risk of owning our stock

•We prohibit executive officers and directors from pledging our securities as collateral for loans (including margin loans)

|

||||

| No “Poison Pill” |

•We do not have a "poison pill" in place

|

||||

| Risk Management |

•We have a rigorous enterprise risk management (ERM) program targeting controls over operational, financial, legal/regulatory compliance, reputational, technology, privacy, data security, strategic, and other risks that could adversely affect our business, which also includes crisis management and business continuity planning

•Through regular reports from management, our board oversees our employee wellness and diversity initiatives

|

||||

| Board Effectiveness Reviews |

•We conduct annual self-assessments of the board and each of its committees, and from time to time include in that process independent third-party effectiveness reviews of the board

|

||||

Board Oversight and Director Independence

Our businesses, property, and affairs are managed under the general direction of our board. In providing this oversight, the board adheres to a set of Corporate Governance Guidelines designed to ensure that the board has access to relevant information and is structured and operates in a manner allowing it to exercise independent business judgment.

A critical component of our corporate governance philosophy is that a majority of our directors meet strict standards of independence, meaning that they have no relationship with our company, directly or indirectly, that could impair their ability to make objective and informed judgments regarding all matters of significance to us and our shareholders. The listing standards of the NYSE require that a majority of our directors be independent, and that our Audit, Compensation and Talent, and Corporate Governance Committees be comprised entirely of independent directors. In order to be deemed independent, a director must be determined by the board to have no material relationship with us other than as a director. In accordance with the NYSE listing standards, our board has adopted formal Director Independence Standards setting forth the specific criteria by which the independence of our directors is determined. These standards include restrictions on the nature and extent of any affiliations that directors and their immediate family members may have with us, our independent registered public accounting firm, or any commercial or not-for-profit entity with which we have a relationship, and also require consideration of any other relationship that may impair independence. Consistent with regulations issued by the SEC and NYSE listing standards, our Director Independence Standards also have heightened standards for Audit and Compensation and Talent Committee members. The complete text of our Director Independence Standards is posted on our website at www.investors.deluxe.com/governance/governance-documents.

17

Following its assessment, the board has determined that every director and nominee, with the exception of Mr. McCarthy, satisfies our Director Independence Standards. The board has also determined that each member of its Audit, Compensation and Talent, Corporate Governance, and Finance Committees is independent.

Corporate Governance Guidelines

Our board has adopted a set of Corporate Governance Guidelines to assist it in carrying out its oversight responsibilities. These guidelines address a broad range of topics, including director qualifications, director nomination processes, director retirement policies, board and committee structure and processes, director education, CEO evaluation, management succession planning and conflicts of interest. Investors may find these guidelines on our website at www.investors.deluxe.com/governance/governance-documents.

Board Effectiveness and Evaluations

Our board and each of its committees conducts an annual self-evaluation of its performance and processes, all of which are overseen by the board's Corporate Governance Committee. These evaluations are designed to ensure that the board and its committees are functioning effectively and to identify any issues or potential areas for improvement. In addition, from time to time, the board undergoes an effectiveness evaluation conducted by an independent, third-party governance expert.

Code of Business Ethics

All of our directors and employees, including our NEOs, are required to comply with our Code of Ethics to help ensure that our business is conducted in accordance with applicable legal and ethical standards. Our Code of Ethics requires strict adherence to the letter and spirit of all laws and regulations applicable to our business, and addresses professional conduct, including customer relationships, respect for co-workers, conflicts of interest, insider trading, the integrity of our financial recordkeeping and reporting, and the protection of our intellectual property and confidential information. Employees are required to report any violations or suspected violations of the Code of Ethics to management or our legal department, or by using our confidential, third-party ethics and compliance hotline. The full text of our Code of Ethics is posted on our website at www.investors.deluxe.com/governance/governance-documents. The Code of Ethics is available in print, free of charge, to any shareholder who submits a request to our Corporate Secretary at Deluxe Corporation, 801 Marquette Avenue South, Minneapolis, Minnesota 55402.

Policies and Procedures with Respect to Related Person Transactions

The board has adopted a written policy under which the Audit Committee is responsible for reviewing and, as appropriate, approving any proposed related person transactions. Specifically, the policy requires that any transaction: (a) involving our company; (b) in which any of our directors, nominees for director, executive officers, or greater than five percent shareholders, their immediate family members, or the associates of these persons have a direct or indirect material interest; and (c) where the amount involved exceeds $120,000 in any fiscal year, be approved in advance by the Audit Committee. A related party transaction may only be approved if the transaction is determined to be consistent with the best interests of the company and its shareholders. In determining whether to approve such transaction, the committee must consider, in addition to other factors deemed appropriate, whether the transaction is on terms generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related person’s interest in the transaction. The committee has the discretion to impose such conditions as it deems necessary and appropriate on the company or the related person in connection with the transaction. No director may participate in any review or approval of any transaction if he or she, or his or her immediate family member, has a direct or indirect material interest in the transaction. There have been no related person transactions since the beginning of 2022 that require disclosure and approval under this policy.

Board Composition and Qualifications

Our Corporate Governance Committee oversees the process for identifying, evaluating and recommending the nomination of candidates for the board. While not maintaining a specific policy on board diversity requirements, we do believe that our directors should have diverse backgrounds and possess a variety of qualifications, experience, and knowledge that complement the attributes of other board members and enable them to contribute effectively to the board's oversight role, and we invite candidates to self-identify diversity in their background, including gender, sexual orientation, race or ethnicity, as well as diversity in their work experiences. We also believe that a predominance of board members should have a background in business, including experience in markets served by us or in which we are developing product and service offerings, and we recognize the benefit of board members having an understanding of the methods by which other boards address issues common to publicly traded companies. We also believe the board should include both actively employed and retired senior corporate officers, and that the board

18

should include directors with a mix of tenures. The board believes that the diverse mix of skills, qualifications and experience represented by the nominees (as addressed more fully above under "Director Skills, Experience, Background and Tenure"), as well as its ongoing evaluation and continuous improvement processes (discussed above under "Board Effectiveness and Evaluations"), enables the board to perform its responsibilities effectively.

The board has established the following specific guidelines for nominees to the board:

•A majority of the board must be comprised of independent directors, the current standards for which are discussed above under "Board Oversight and Director Independence."

•Non-employees should not be nominated for re-election to the board after their 75th birthday.

•A non-employee director who ceases to hold the employment position held at the time of election to the board, or who has a significant change in position, must offer to resign from the board. The Corporate Governance Committee will then consider whether the change of status is likely to impact the director's qualifications and make a recommendation to the board as to whether the resignation should be accepted.

•Management directors who terminate employment with our company or experience a reduction in employment level, position, or responsibilities, must offer to resign from the board. The board will then decide whether to accept the director's resignation, provided that no more than one former CEO of the company should serve on the board at any one time.

Director Selection Process

All board members are elected annually by our shareholders, subject to the board's right to fill vacancies in existing or new director positions on an interim basis. Based on advice from the Corporate Governance Committee, each year the board recommends a slate of nominees to be presented for election at the annual meeting of shareholders.