EXHIBIT 99.1

Published on June 5, 2017

Deluxe Corporation

Investor Presentation – June 2017

2

Forward-Looking Statements

This presentation contains forward-looking statements based upon information

available to management as of the date hereof and management assumes no

obligation to update or revise any such forward-looking statements. All estimates

and projections are subject to risks and uncertainties that could cause actual

future results to differ materially from those results estimated or projected.

Additional information about various factors that could cause actual results to

differ from those projected can be found in the Company’s Form 10-K for the

year ended December 31, 2016.

Non-GAAP financial measures discussed in this presentation are reconciled to

the comparable GAAP financial measure at the end of this presentation in the

appendix.

Any estimates, projections, expectations, outlook, etc. in this presentation are

dated as of the first quarter 2017 earnings release on April 27, 2017. No

forward-looking statements are being reaffirmed by inclusion in this

presentation.

3

Lee Schram

Chief Executive Officer

Keith Bush

Chief Financial Officer

and Senior Vice President

Ed Merritt

Treasurer and Vice President

of Investor Relations

Deluxe Investor Contacts

4

About Deluxe… Did You Know?

• Majority of revenue recurring through diversified base of

products & services; faster growing Marketing Solutions &

Other Services (MOS) expected to represent 38% of revenue in

2017 and 40% in 2018

• Increased revenue from sources other than checks to over 53%

• 4.4 million active small business customers

• Trusted advisor to 5,600 financial institutions

• Deluxe solutions in 95 of top 100 U.S. financial institutions

• Consistent financial growth over past 7 years, including

revenue, earnings per share and operating cash flow

5

39%

29%

32%

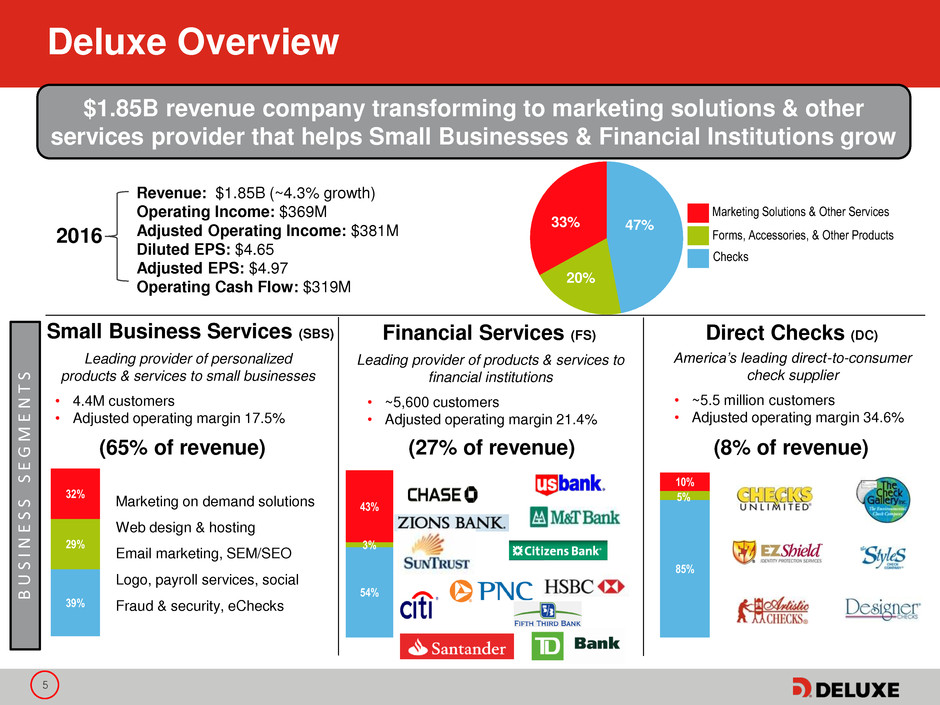

Deluxe Overview

Financial Services (FS) Small Business Services (SBS) Direct Checks (DC)

Leading provider of products & services to

financial institutions

• ~5,600 customers

• Adjusted operating margin 21.4%

America’s leading direct-to-consumer

check supplier

• ~5.5 million customers

• Adjusted operating margin 34.6%

(27% of revenue)

54%

3%

43%

Marketing Solutions & Other Services

Forms, Accessories, & Other Products

Checks

47%

20%

33%

Revenue: $1.85B (~4.3% growth)

Operating Income: $369M

Adjusted Operating Income: $381M

Diluted EPS: $4.65

Adjusted EPS: $4.97

Operating Cash Flow: $319M

2016

(65% of revenue)

Leading provider of personalized

products & services to small businesses

• 4.4M customers

• Adjusted operating margin 17.5%

$1.85B revenue company transforming to marketing solutions & other

services provider that helps Small Businesses & Financial Institutions grow

(8% of revenue)

Marketing on demand solutions

Web design & hosting

Email marketing, SEM/SEO

Logo, payroll services, social

Fraud & security, eChecks

85%

5%

10%

B

U

S

I

N

E

S

S

S

E

G

M

E

N

T

S

6

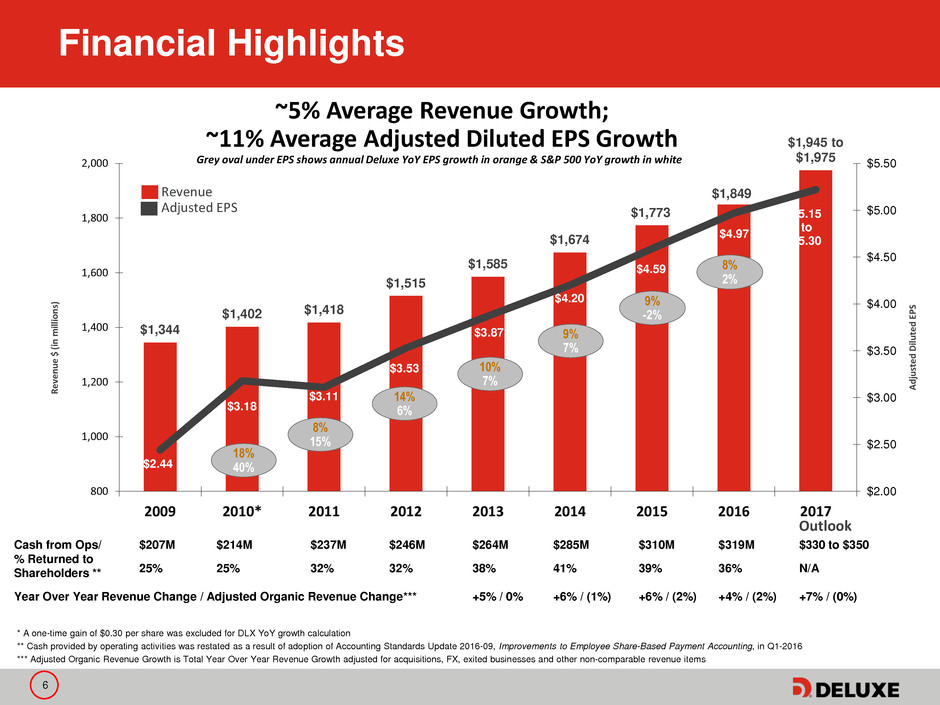

$1,344

$1,402 $1,418

$1,515

$1,585

$1,674

$1,773

$1,849

$1,945 to

$1,975

$2.44

$3.18

$3.11

$3.53

$3.87

$4.20

$4.59

$4.97

$5.15

to

$5.30

$2.00

$2.50

$3.00

$3.50

$4.00

$4.50

$5.00

$5.50

800

1,000

1,200

1,400

1,600

1,800

2,000

2009 2010* 2011 2012 2013 2014 2015 2016 2017

R

e

ve

n

u

e

$

(i

n

m

ill

io

n

s)

18%

40%

8%

15%

14%

6%

10%

7%

9%

7%

9%

-2%

~5% Average Revenue Growth;

~11% Average Adjusted Diluted EPS Growth

Grey oval under EPS shows annual Deluxe YoY EPS growth in orange & S&P 500 YoY growth in white

Adjust

e

d

D

ilu

te

d

E

P

S

Financial Highlights

* A one-time gain of $0.30 per share was excluded for DLX YoY growth calculation

** Cash provided by operating activities was restated as a result of adoption of Accounting Standards Update 2016-09, Improvements to Employee Share-Based Payment Accounting, in Q1-2016

*** Adjusted Organic Revenue Growth is Total Year Over Year Revenue Growth adjusted for acquisitions, FX, exited businesses and other non-comparable revenue items

8%

2%

Cash from Ops/

% Returned to

Shareholders **

$207M $214M $237M $246M $264M $285M $310M $319M $330 to $350

25% 25% 32% 32% 38% 41% 39% 36% N/A

Year Over Year Revenue Change / Adjusted Organic Revenue Change*** +5% / 0% +6% / (1%) +6% / (2%) +4% / (2%) +7% / (0%)

Revenue

Adjusted EPS

Outlook

7

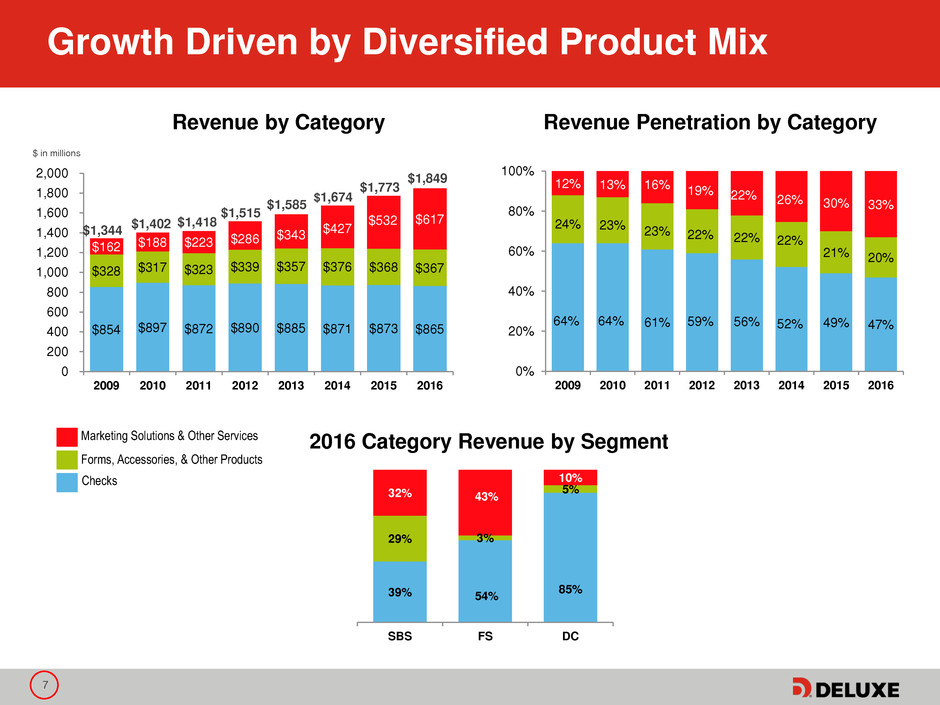

Growth Driven by Diversified Product Mix

Revenue by Category Revenue Penetration by Category

$ in millions

$854 $897 $872 $890 $885 $871 $873 $865

$328 $317 $323 $339 $357 $376 $368 $367

$162 $188 $223

$286 $343

$427

$532 $617

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2009 2010 2011 2012 2013 2014 2015 2016

$1,674

64% 64% 61% 59% 56% 52% 49% 47%

24% 23% 23% 22% 22% 22%

21% 20%

12% 13% 16% 19% 22% 26% 30% 33%

0%

20%

40%

60%

80%

100%

2009 2010 2011 2012 2013 2014 2015 2016

$1,344 $1,402

$1,418

$1,515

$1,585

39% 54%

85%

29% 3%

5% 32% 43%

10%

SBS FS DC

2016 Category Revenue by Segment

$1,773

Marketing Solutions & Other Services

Forms, Accessories, & Other Products

Checks

$1,849

8

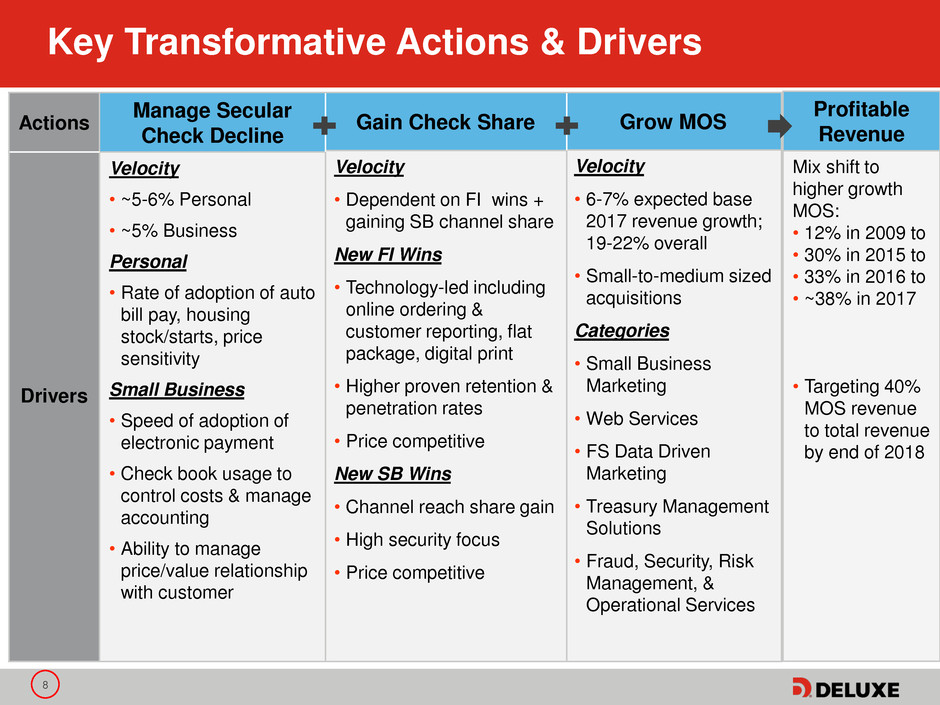

Grow MOS

Velocity

• 6-7% expected base

2017 revenue growth;

19-22% overall

• Small-to-medium sized

acquisitions

Categories

• Small Business

Marketing

• Web Services

• FS Data Driven

Marketing

• Treasury Management

Solutions

• Fraud, Security, Risk

Management, &

Operational Services

Gain Check Share

Velocity

• Dependent on FI wins +

gaining SB channel share

New FI Wins

• Technology-led including

online ordering &

customer reporting, flat

package, digital print

• Higher proven retention &

penetration rates

• Price competitive

New SB Wins

• Channel reach share gain

• High security focus

• Price competitive

Key Transformative Actions & Drivers

Actions

Manage Secular

Check Decline

Drivers

Velocity

• ~5-6% Personal

• ~5% Business

Personal

• Rate of adoption of auto

bill pay, housing

stock/starts, price

sensitivity

Small Business

• Speed of adoption of

electronic payment

• Check book usage to

control costs & manage

accounting

• Ability to manage

price/value relationship

with customer

Profitable

Revenue

Mix shift to

higher growth

MOS:

• 12% in 2009 to

• 30% in 2015 to

• 33% in 2016 to

• ~38% in 2017

• Targeting 40%

MOS revenue

to total revenue

by end of 2018

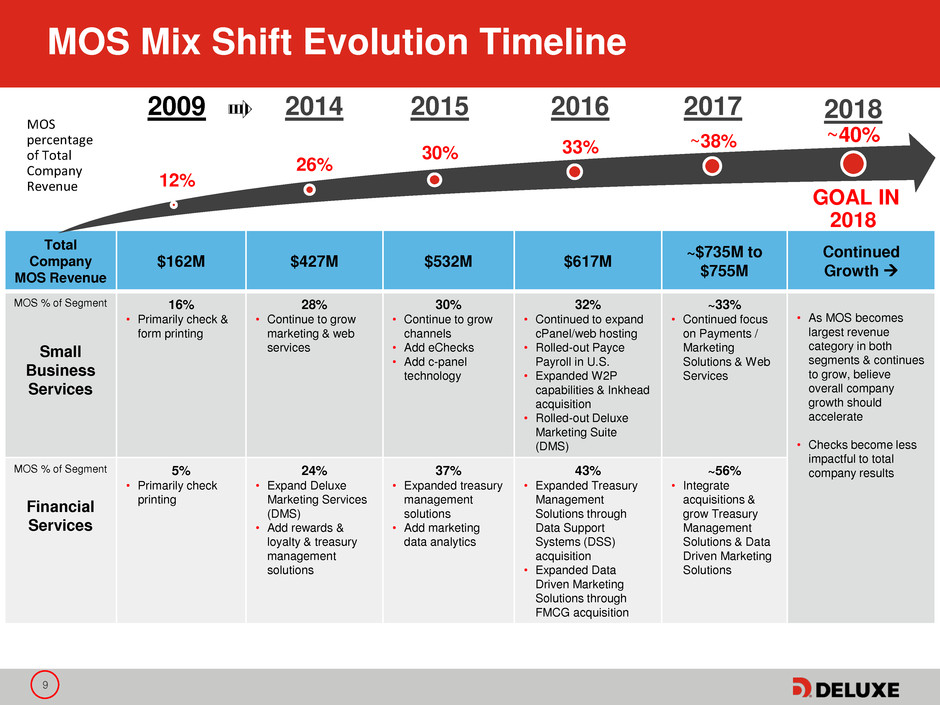

9

MOS Mix Shift Evolution Timeline

Total

Company

MOS Revenue

$162M $427M $532M $617M

~$735M to

$755M

Continued

Growth

MOS % of Segment

Small

Business

Services

16%

• Primarily check &

form printing

28%

• Continue to grow

marketing & web

services

30%

• Continue to grow

channels

• Add eChecks

• Add c-panel

technology

32%

• Continued to expand

cPanel/web hosting

• Rolled-out Payce

Payroll in U.S.

• Expanded W2P

capabilities & Inkhead

acquisition

• Rolled-out Deluxe

Marketing Suite

(DMS)

~33%

• Continued focus

on Payments /

Marketing

Solutions & Web

Services

• As MOS becomes

largest revenue

category in both

segments & continues

to grow, believe

overall company

growth should

accelerate

• Checks become less

impactful to total

company results

MOS % of Segment

Financial

Services

5%

• Primarily check

printing

24%

• Expand Deluxe

Marketing Services

(DMS)

• Add rewards &

loyalty & treasury

management

solutions

37%

• Expanded treasury

management

solutions

• Add marketing

data analytics

43%

• Expanded Treasury

Management

Solutions through

Data Support

Systems (DSS)

acquisition

• Expanded Data

Driven Marketing

Solutions through

FMCG acquisition

~56%

• Integrate

acquisitions &

grow Treasury

Management

Solutions & Data

Driven Marketing

Solutions

2009

12%

2014

26%

2015

30%

2016

33%

2018

~40%

GOAL IN

2018

MOS

percentage

of Total

Company

Revenue

2017

~38%

10

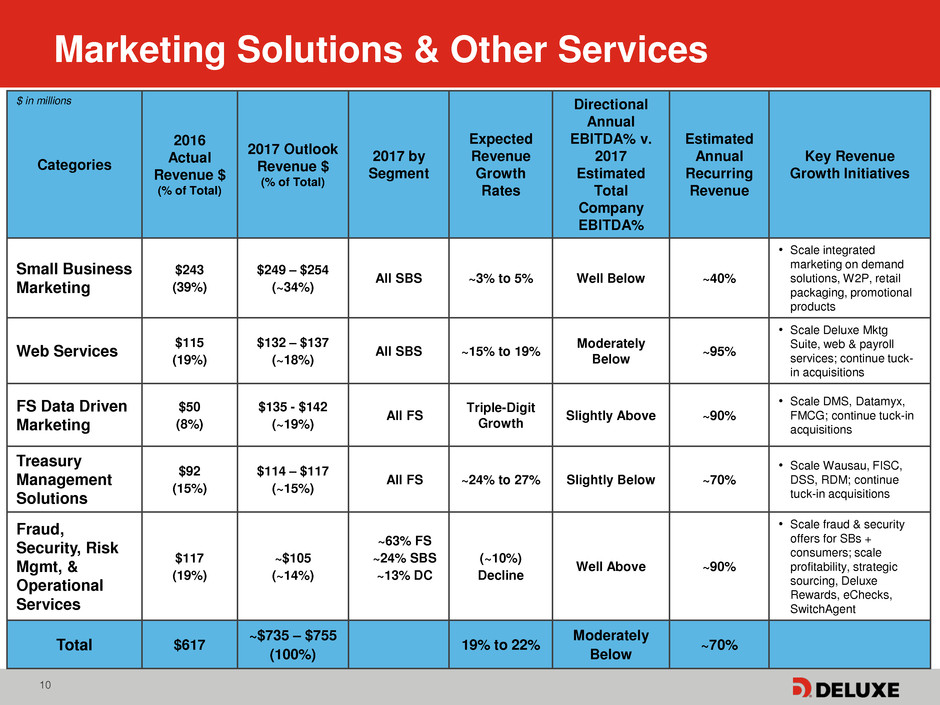

Marketing Solutions & Other Services

Categories

2016

Actual

Revenue $

(% of Total)

2017 Outlook

Revenue $

(% of Total)

2017 by

Segment

Expected

Revenue

Growth

Rates

Directional

Annual

EBITDA% v.

2017

Estimated

Total

Company

EBITDA%

Estimated

Annual

Recurring

Revenue

Key Revenue

Growth Initiatives

Small Business

Marketing

$243

(39%)

$249 – $254

(~34%)

All SBS ~3% to 5% Well Below ~40%

• Scale integrated

marketing on demand

solutions, W2P, retail

packaging, promotional

products

Web Services

$115

(19%)

$132 – $137

(~18%)

All SBS ~15% to 19%

Moderately

Below

~95%

• Scale Deluxe Mktg

Suite, web & payroll

services; continue tuck-

in acquisitions

FS Data Driven

Marketing

$50

(8%)

$135 - $142

(~19%)

All FS

Triple-Digit

Growth

Slightly Above ~90%

• Scale DMS, Datamyx,

FMCG; continue tuck-in

acquisitions

Treasury

Management

Solutions

$92

(15%)

$114 – $117

(~15%)

All FS ~24% to 27% Slightly Below ~70%

• Scale Wausau, FISC,

DSS, RDM; continue

tuck-in acquisitions

Fraud,

Security, Risk

Mgmt, &

Operational

Services

$117

(19%)

~$105

(~14%)

~63% FS

~24% SBS

~13% DC

(~10%)

Decline

Well Above ~90%

• Scale fraud & security

offers for SBs +

consumers; scale

profitability, strategic

sourcing, Deluxe

Rewards, eChecks,

SwitchAgent

Total $617

~$735 – $755

(100%)

19% to 22%

Moderately

Below

~70%

$ in millions

11

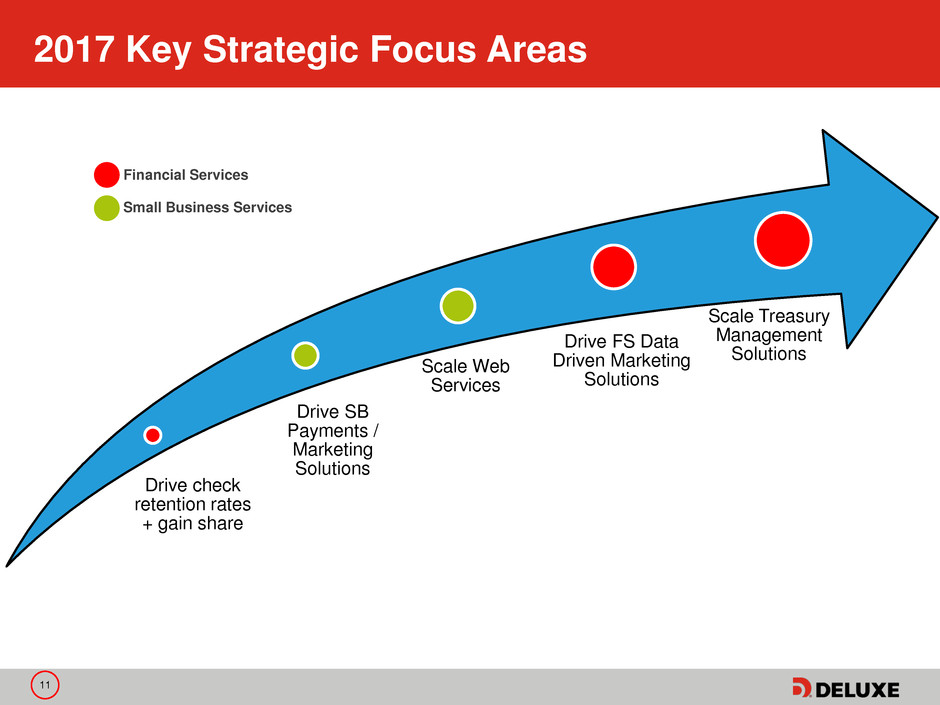

Drive check

retention rates

+ gain share

Drive SB

Payments /

Marketing

Solutions

Scale Web

Services

Drive FS Data

Driven Marketing

Solutions

Scale Treasury

Management

Solutions

2017 Key Strategic Focus Areas

Financial Services

Small Business Services

12

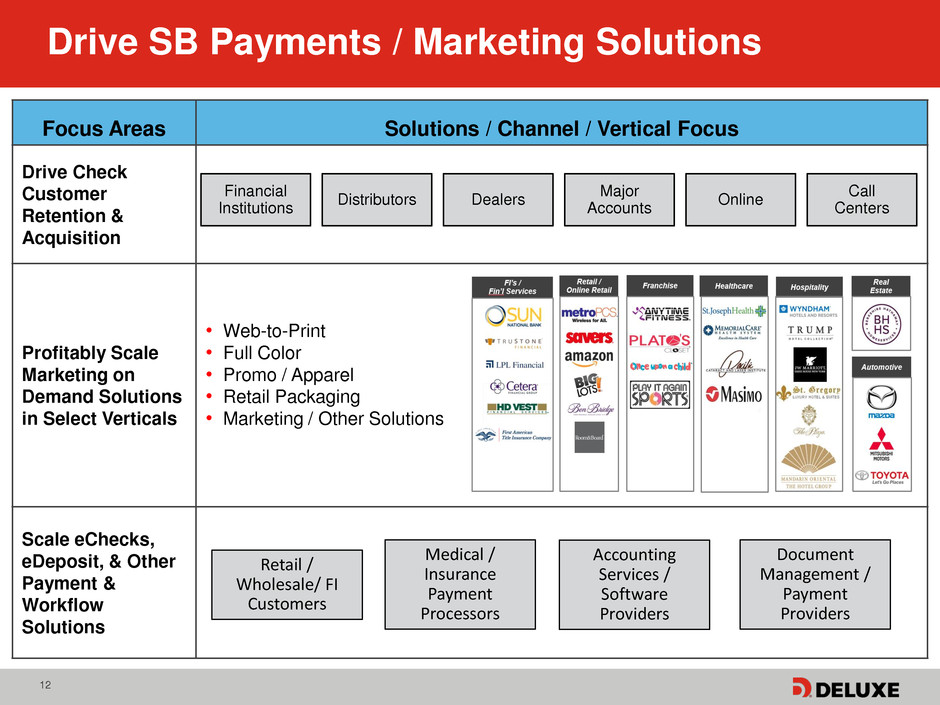

Focus Areas Solutions / Channel / Vertical Focus

Drive Check

Customer

Retention &

Acquisition

Profitably Scale

Marketing on

Demand Solutions

in Select Verticals

• Web-to-Print

• Full Color

• Promo / Apparel

• Retail Packaging

• Marketing / Other Solutions

Scale eChecks,

eDeposit, & Other

Payment &

Workflow

Solutions

Drive SB Payments / Marketing Solutions

Medical /

Insurance

Payment

Processors

Accounting

Services /

Software

Providers

Document

Management /

Payment

Providers

Retail /

Wholesale/ FI

Customers

Financial

Institutions

Distributors Dealers

Major

Accounts

Online

Call

Centers

13

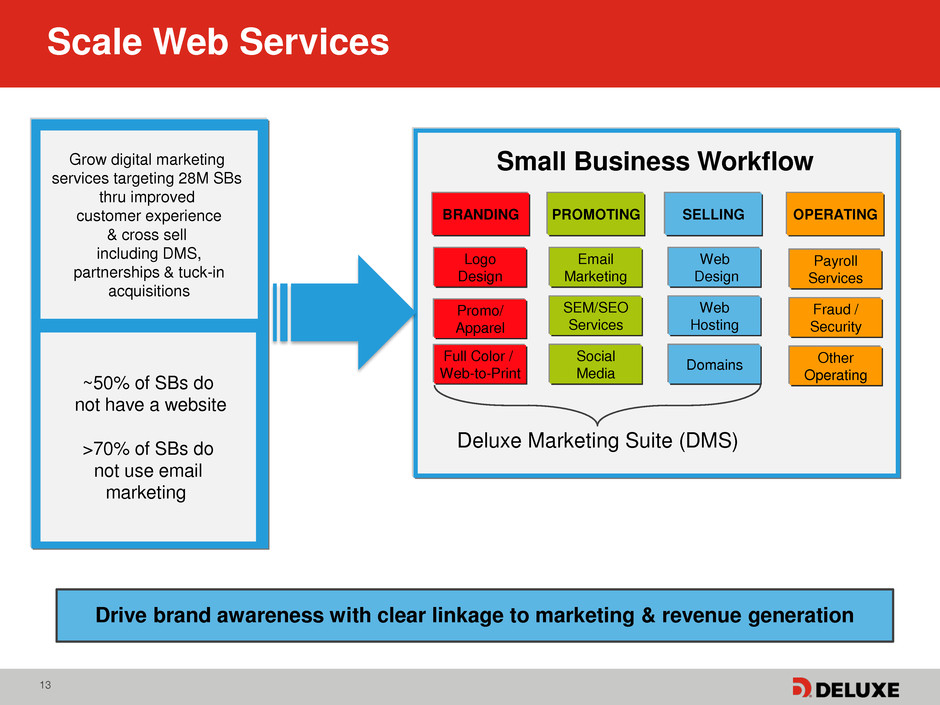

Scale Web Services

Domains

PROMOTING OPERATING

Social

Media

SEM/SEO

Services

Email

Marketing

Other

Operating

Fraud /

Security

Payroll

Services

Web

Hosting

Web

Design

SELLING

Small Business Workflow Grow digital marketing

services targeting 28M SBs

thru improved

customer experience

& cross sell

including DMS,

partnerships & tuck-in

acquisitions

~50% of SBs do

not have a website

>70% of SBs do

not use email

marketing

BRANDING

Full Color /

Web-to-Print

Promo/

Apparel

Logo

Design

Deluxe Marketing Suite (DMS)

Drive brand awareness with clear linkage to marketing & revenue generation

14

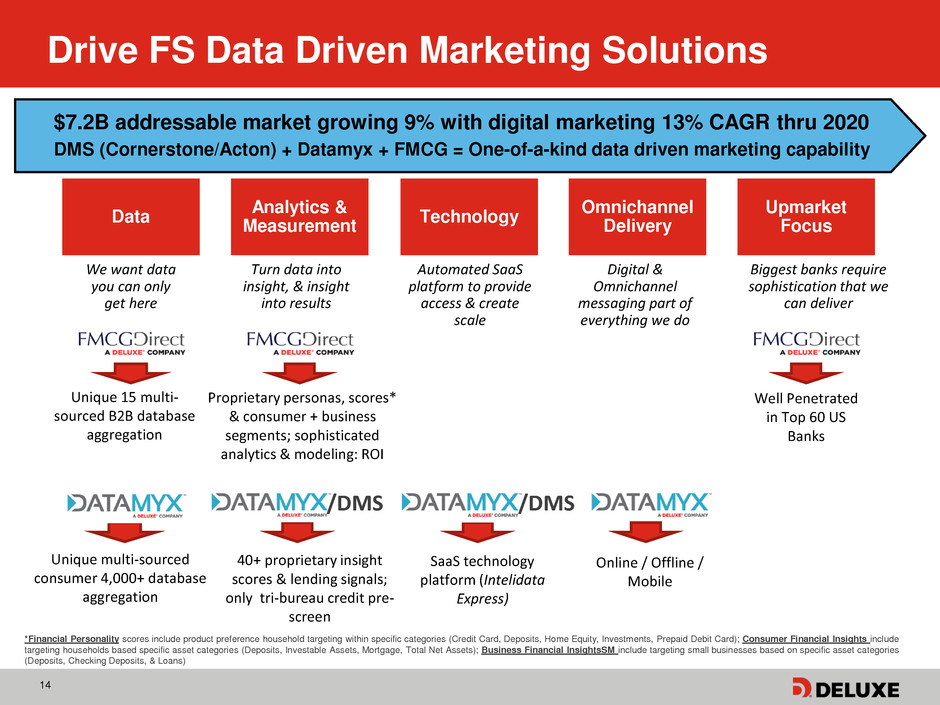

Drive FS Data Driven Marketing Solutions

Data

Upmarket

Focus

Omnichannel

Delivery

Analytics &

Measurement

We want data

you can only

get here

Biggest banks require

sophistication that we

can deliver

Digital &

Omnichannel

messaging part of

everything we do

Turn data into

insight, & insight

into results

Technology

Automated SaaS

platform to provide

access & create

scale

Unique 15 multi-

sourced B2B database

aggregation

Proprietary personas, scores*

& consumer + business

segments; sophisticated

analytics & modeling: ROI

Well Penetrated

in Top 60 US

Banks

$7.2B addressable market growing 9% with digital marketing 13% CAGR thru 2020

DMS (Cornerstone/Acton) + Datamyx + FMCG = One-of-a-kind data driven marketing capability

*Financial Personality scores include product preference household targeting within specific categories (Credit Card, Deposits, Home Equity, Investments, Prepaid Debit Card); Consumer Financial Insights include

targeting households based specific asset categories (Deposits, Investable Assets, Mortgage, Total Net Assets); Business Financial InsightsSM include targeting small businesses based on specific asset categories

(Deposits, Checking Deposits, & Loans)

Unique multi-sourced

consumer 4,000+ database

aggregation

40+ proprietary insight

scores & lending signals;

only tri-bureau credit pre-

screen

SaaS technology

platform (Intelidata

Express)

Online / Offline /

Mobile

/DMS /DMS

15

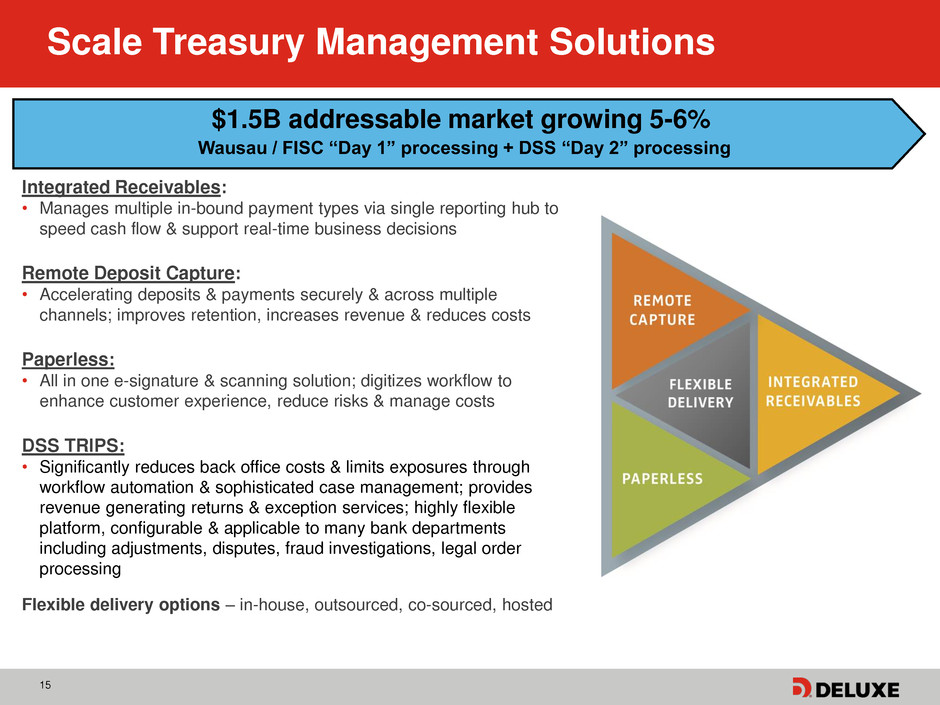

Scale Treasury Management Solutions

Integrated Receivables:

• Manages multiple in-bound payment types via single reporting hub to

speed cash flow & support real-time business decisions

Remote Deposit Capture:

• Accelerating deposits & payments securely & across multiple

channels; improves retention, increases revenue & reduces costs

Paperless:

• All in one e-signature & scanning solution; digitizes workflow to

enhance customer experience, reduce risks & manage costs

DSS TRIPS:

• Significantly reduces back office costs & limits exposures through

workflow automation & sophisticated case management; provides

revenue generating returns & exception services; highly flexible

platform, configurable & applicable to many bank departments

including adjustments, disputes, fraud investigations, legal order

processing

Flexible delivery options – in-house, outsourced, co-sourced, hosted

$1.5B addressable market growing 5-6%

Wausau / FISC “Day 1” processing + DSS “Day 2” processing

16

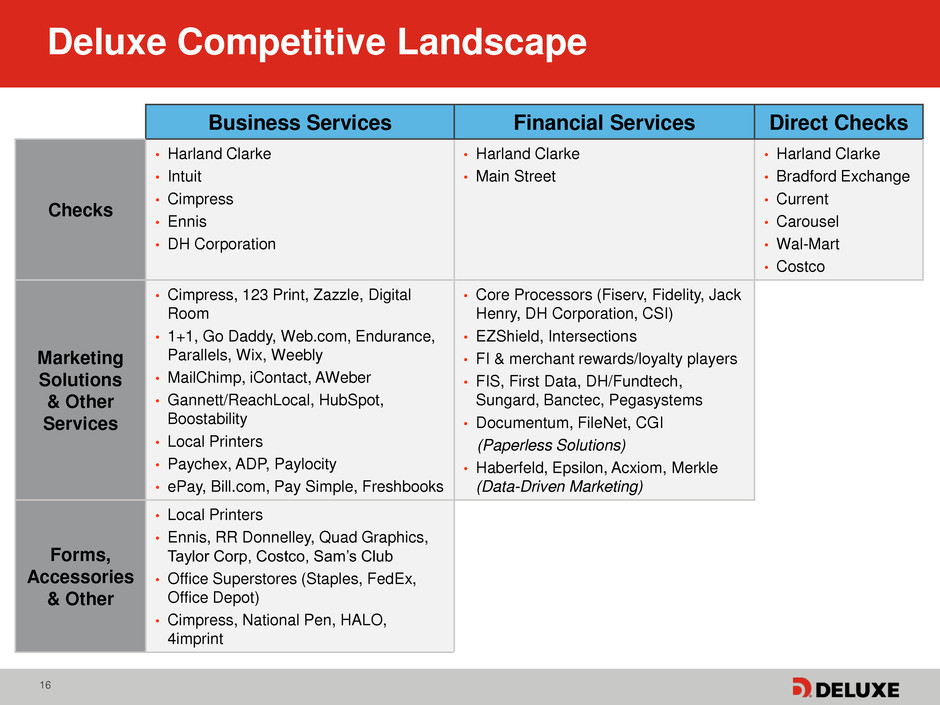

Business Services Financial Services Direct Checks

Checks

• Harland Clarke

• Intuit

• Cimpress

• Ennis

• DH Corporation

• Harland Clarke

• Main Street

• Harland Clarke

• Bradford Exchange

• Current

• Carousel

• Wal-Mart

• Costco

Marketing

Solutions

& Other

Services

• Cimpress, 123 Print, Zazzle, Digital

Room

• 1+1, Go Daddy, Web.com, Endurance,

Parallels, Wix, Weebly

• MailChimp, iContact, AWeber

• Gannett/ReachLocal, HubSpot,

Boostability

• Local Printers

• Paychex, ADP, Paylocity

• ePay, Bill.com, Pay Simple, Freshbooks

• Core Processors (Fiserv, Fidelity, Jack

Henry, DH Corporation, CSI)

• EZShield, Intersections

• FI & merchant rewards/loyalty players

• FIS, First Data, DH/Fundtech,

Sungard, Banctec, Pegasystems

• Documentum, FileNet, CGI

(Paperless Solutions)

• Haberfeld, Epsilon, Acxiom, Merkle

(Data-Driven Marketing)

Forms,

Accessories

& Other

• Local Printers

• Ennis, RR Donnelley, Quad Graphics,

Taylor Corp, Costco, Sam’s Club

• Office Superstores (Staples, FedEx,

Office Depot)

• Cimpress, National Pen, HALO,

4imprint

Deluxe Competitive Landscape

17

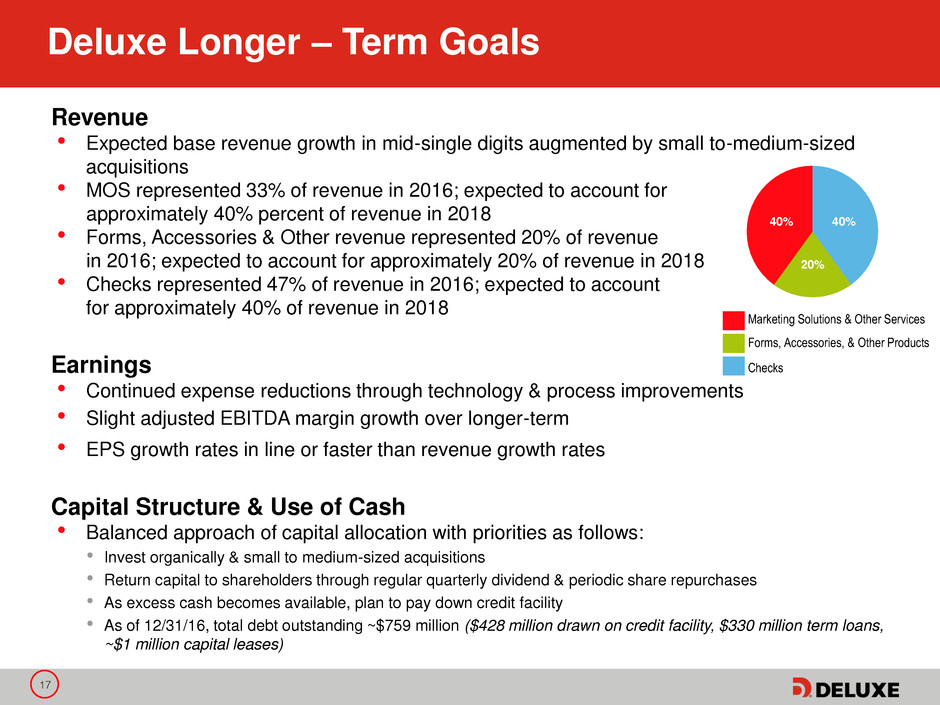

Deluxe Longer – Term Goals

Revenue

• Expected base revenue growth in mid-single digits augmented by small to-medium-sized

acquisitions

• MOS represented 33% of revenue in 2016; expected to account for

approximately 40% percent of revenue in 2018

• Forms, Accessories & Other revenue represented 20% of revenue

in 2016; expected to account for approximately 20% of revenue in 2018

• Checks represented 47% of revenue in 2016; expected to account

for approximately 40% of revenue in 2018

Earnings

• Continued expense reductions through technology & process improvements

• Slight adjusted EBITDA margin growth over longer-term

• EPS growth rates in line or faster than revenue growth rates

Capital Structure & Use of Cash

• Balanced approach of capital allocation with priorities as follows:

• Invest organically & small to medium-sized acquisitions

• Return capital to shareholders through regular quarterly dividend & periodic share repurchases

• As excess cash becomes available, plan to pay down credit facility

• As of 12/31/16, total debt outstanding ~$759 million ($428 million drawn on credit facility, $330 million term loans,

~$1 million capital leases)

Marketing Solutions & Other Services

Forms, Accessories, & Other Products

Checks

40%

20%

40%

18

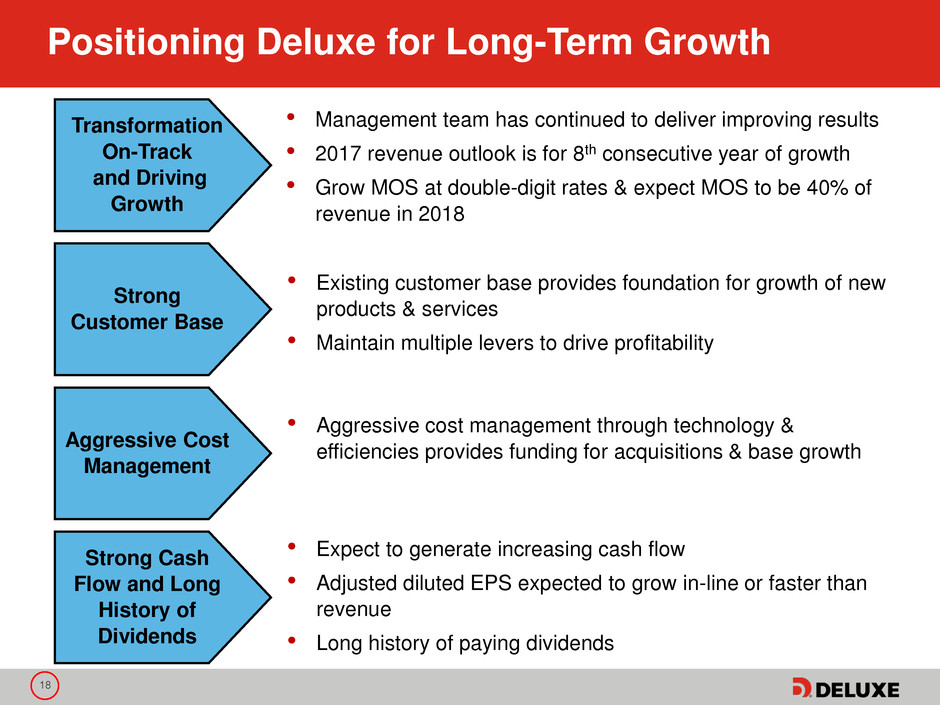

Positioning Deluxe for Long-Term Growth

• Management team has continued to deliver improving results

• 2017 revenue outlook is for 8th consecutive year of growth

• Grow MOS at double-digit rates & expect MOS to be 40% of

revenue in 2018

• Existing customer base provides foundation for growth of new

products & services

• Maintain multiple levers to drive profitability

• Aggressive cost management through technology &

efficiencies provides funding for acquisitions & base growth

• Expect to generate increasing cash flow

• Adjusted diluted EPS expected to grow in-line or faster than

revenue

• Long history of paying dividends

Strong Cash

Flow and Long

History of

Dividends

Transformation

On-Track

and Driving

Growth

Strong

Customer Base

Aggressive Cost

Management

19

Appendix

Reconciliations

20

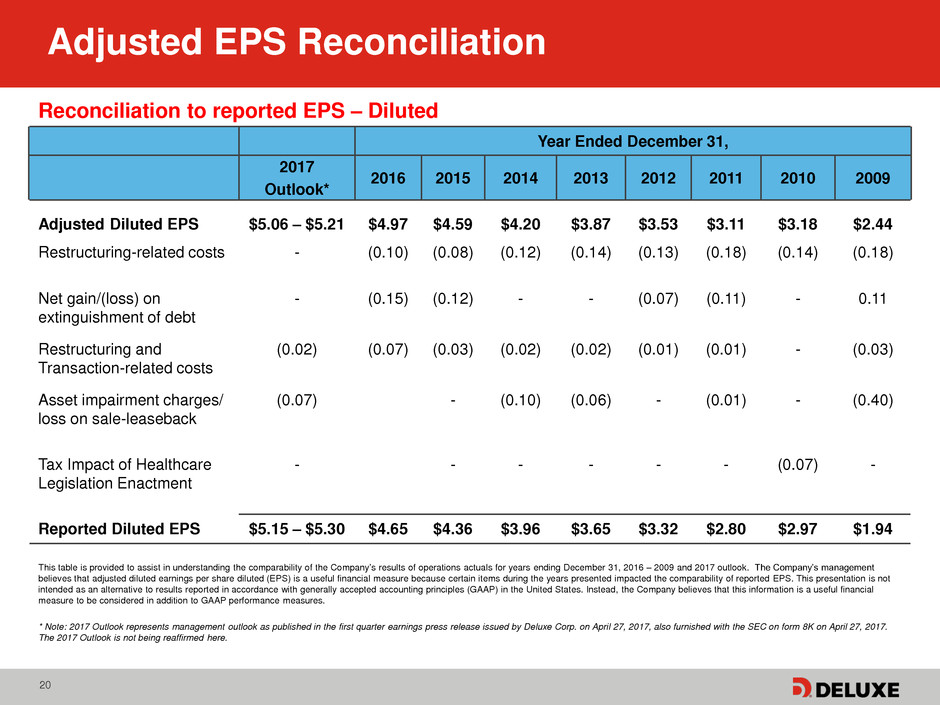

Adjusted EPS Reconciliation

Reconciliation to reported EPS – Diluted

Year Ended December 31,

2017

Outlook*

2016 2015 2014 2013 2012 2011 2010 2009

Adjusted Diluted EPS $5.06 – $5.21 $4.97 $4.59 $4.20 $3.87 $3.53 $3.11 $3.18 $2.44

Restructuring-related costs - (0.10) (0.08) (0.12) (0.14) (0.13) (0.18) (0.14) (0.18)

Net gain/(loss) on

extinguishment of debt

- (0.15) (0.12) - - (0.07) (0.11) -

0.11

Restructuring and

Transaction-related costs

(0.02) (0.07) (0.03) (0.02) (0.02) (0.01) (0.01) -

(0.03)

Asset impairment charges/

loss on sale-leaseback

(0.07) - (0.10) (0.06) - (0.01) -

(0.40)

Tax Impact of Healthcare

Legislation Enactment

- - - - - - (0.07) -

Reported Diluted EPS $5.15 – $5.30 $4.65 $4.36 $3.96 $3.65 $3.32 $2.80 $2.97 $1.94

This table is provided to assist in understanding the comparability of the Company’s results of operations actuals for years ending December 31, 2016 – 2009 and 2017 outlook. The Company’s management

believes that adjusted diluted earnings per share diluted (EPS) is a useful financial measure because certain items during the years presented impacted the comparability of reported EPS. This presentation is not

intended as an alternative to results reported in accordance with generally accepted accounting principles (GAAP) in the United States. Instead, the Company believes that this information is a useful financial

measure to be considered in addition to GAAP performance measures.

* Note: 2017 Outlook represents management outlook as published in the first quarter earnings press release issued by Deluxe Corp. on April 27, 2017, also furnished with the SEC on form 8K on April 27, 2017.

The 2017 Outlook is not being reaffirmed here.

21

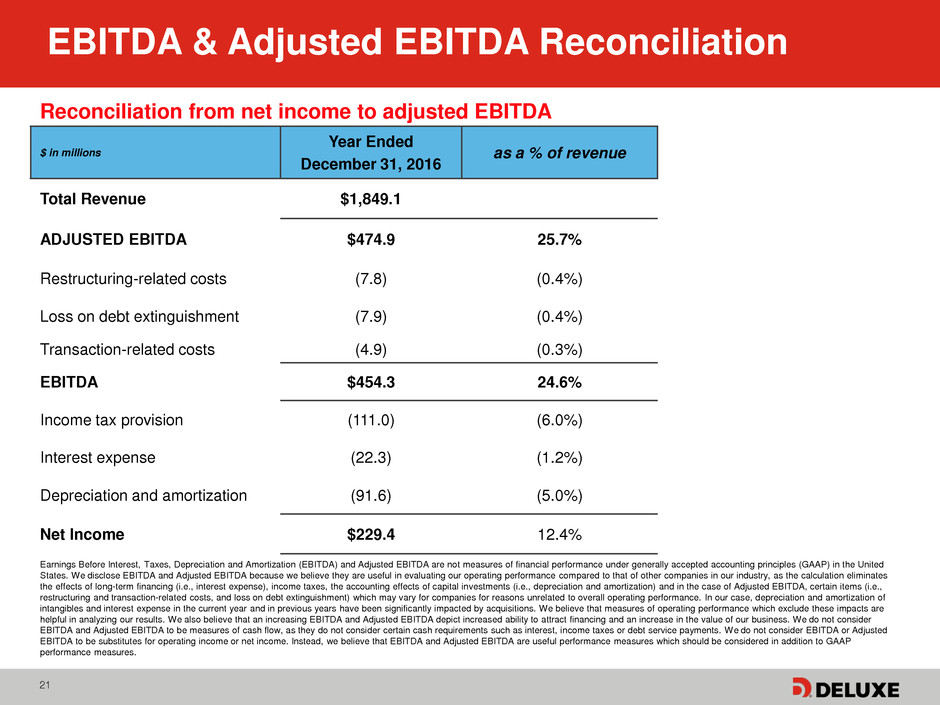

EBITDA & Adjusted EBITDA Reconciliation

Reconciliation from net income to adjusted EBITDA

$ in millions

Year Ended

December 31, 2016

as a % of revenue

Total Revenue $1,849.1

ADJUSTED EBITDA $474.9 25.7%

Restructuring-related costs (7.8) (0.4%)

Loss on debt extinguishment (7.9) (0.4%)

Transaction-related costs (4.9) (0.3%)

EBITDA $454.3 24.6%

Income tax provision (111.0) (6.0%)

Interest expense (22.3) (1.2%)

Depreciation and amortization (91.6) (5.0%)

Net Income $229.4 12.4%

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA are not measures of financial performance under generally accepted accounting principles (GAAP) in the United

States. We disclose EBITDA and Adjusted EBITDA because we believe they are useful in evaluating our operating performance compared to that of other companies in our industry, as the calculation eliminates

the effects of long-term financing (i.e., interest expense), income taxes, the accounting effects of capital investments (i.e., depreciation and amortization) and in the case of Adjusted EBITDA, certain items (i.e.,

restructuring and transaction-related costs, and loss on debt extinguishment) which may vary for companies for reasons unrelated to overall operating performance. In our case, depreciation and amortization of

intangibles and interest expense in the current year and in previous years have been significantly impacted by acquisitions. We believe that measures of operating performance which exclude these impacts are

helpful in analyzing our results. We also believe that an increasing EBITDA and Adjusted EBITDA depict increased ability to attract financing and an increase in the value of our business. We do not consider

EBITDA and Adjusted EBITDA to be measures of cash flow, as they do not consider certain cash requirements such as interest, income taxes or debt service payments. We do not consider EBITDA or Adjusted

EBITDA to be substitutes for operating income or net income. Instead, we believe that EBITDA and Adjusted EBITDA are useful performance measures which should be considered in addition to GAAP

performance measures.

22

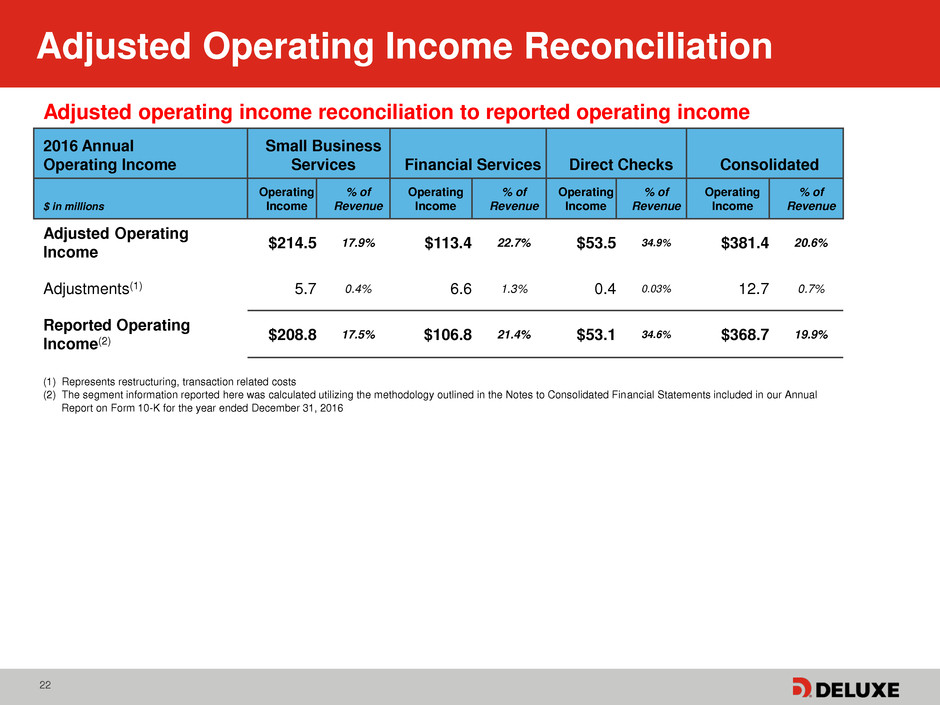

Adjusted Operating Income Reconciliation

Adjusted operating income reconciliation to reported operating income

2016 Annual

Operating Income

Small Business

Services Financial Services Direct Checks Consolidated

$ in millions

Operating

Income

% of

Revenue

Operating

Income

% of

Revenue

Operating

Income

% of

Revenue

Operating

Income

% of

Revenue

Adjusted Operating

Income

$214.5 17.9% $113.4 22.7% $53.5 34.9% $381.4 20.6%

Adjustments(1) 5.7 0.4% 6.6 1.3% 0.4 0.03% 12.7 0.7%

Reported Operating

Income(2)

$208.8 17.5% $106.8 21.4% $53.1 34.6% $368.7 19.9%

(1) Represents restructuring, transaction related costs

(2) The segment information reported here was calculated utilizing the methodology outlined in the Notes to Consolidated Financial Statements included in our Annual

Report on Form 10-K for the year ended December 31, 2016

23

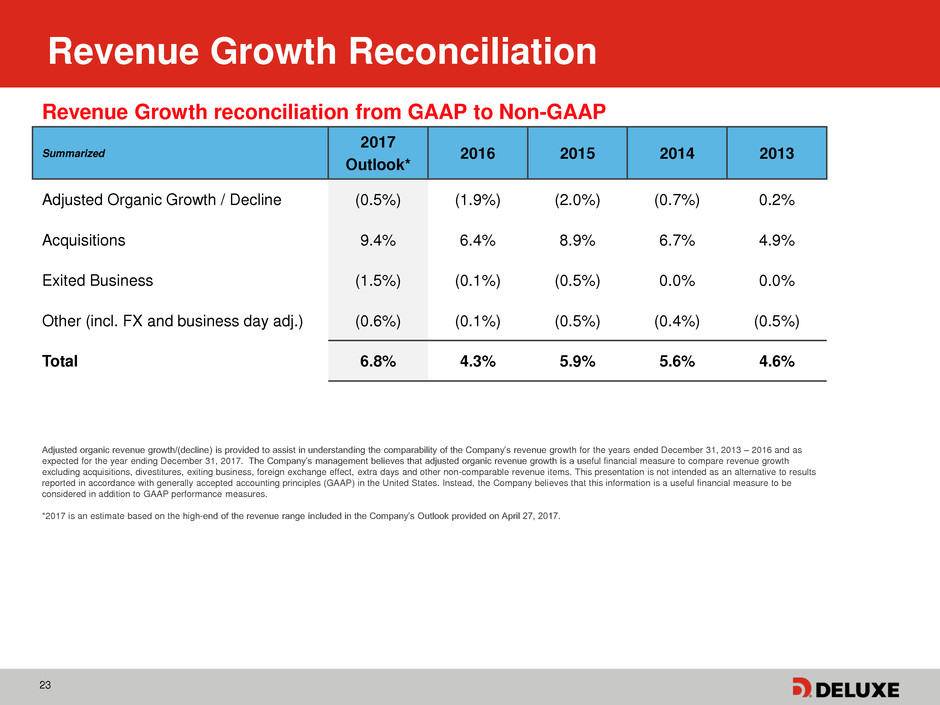

Revenue Growth Reconciliation

Revenue Growth reconciliation from GAAP to Non-GAAP

Summarized

2017

Outlook*

2016 2015 2014 2013

Adjusted Organic Growth / Decline (0.5%) (1.9%) (2.0%) (0.7%) 0.2%

Acquisitions 9.4% 6.4% 8.9% 6.7% 4.9%

Exited Business (1.5%) (0.1%) (0.5%) 0.0% 0.0%

Other (incl. FX and business day adj.) (0.6%) (0.1%) (0.5%) (0.4%) (0.5%)

Total 6.8% 4.3% 5.9% 5.6% 4.6%

Adjusted organic revenue growth/(decline) is provided to assist in understanding the comparability of the Company’s revenue growth for the years ended December 31, 2013 – 2016 and as

expected for the year ending December 31, 2017. The Company’s management believes that adjusted organic revenue growth is a useful financial measure to compare revenue growth

excluding acquisitions, divestitures, exiting business, foreign exchange effect, extra days and other non-comparable revenue items. This presentation is not intended as an alternative to results

reported in accordance with generally accepted accounting principles (GAAP) in the United States. Instead, the Company believes that this information is a useful financial measure to be

considered in addition to GAAP performance measures.

*2017 is an estimate based on the high-end of the revenue range included in the Company’s Outlook provided on April 27, 2017.

24

Investor Contact

Ed Merritt

Treasurer and Vice President

of Investor Relations

ed.merritt@deluxe.com

Tel: 651-787-1370