EXHIBIT 99.1

Published on October 25, 2019

Third Quarter Earnings Call October 24, 2019

ED MERRITT TREASURER AND VICE PRESIDENT OF INVESTOR RELATIONS 2

TODAYS PRESENTERS Barry McCarthy Keith Bush Ed Merritt President and Chief Financial Officer and Treasurer and Vice President Chief Executive Officer Senior Vice President of Investor Relations 3

CAUTIONARY STATEMENT Comments made today regarding financial estimates, projections, and management’s intentions and expectations regarding the Company's future performance, are forward-looking in nature as defined in the Private Securities Litigation Reform Act of 1995. These comments are subject to risks and uncertainties, which could cause actual results to differ materially from those projected. Additional information about various factors that could cause actual results to differ from projections are contained in the press release that we issued today as well as in the company's Form 10-K for the year ended December 31, 2018. Portions of the financial and statistical information that will be reviewed during this call are addressed in more detail in today's press release which is posted on our investor relations website at deluxe.com/investor. This information was also furnished to the SEC on Form 8-K filed by the Company this afternoon. References to non-GAAP financial measures are reconciled to the comparable GAAP financial measures in the press release or as part of this presentation. 4

BARRY McCARTHY PRESIDENT AND CHIEF EXECUTIVE OFFICER 5

AGENDA FOR TODAY • Strong third quarter operating performance • Met revenue commitment, exceeded adjusted diluted EPS outlook • Executing well on new strategy • Reinvigorating the culture • Driving equity ownership • Implementing modern technology infrastructure • Signing new contracts at an unprecedented rate • Attracting world class talent • Welcomed Cheryl Mayberry-McKissick as new, independent board chair • Succeeds Martyn Redgrave who remains on the board after 7 years as chairman 6

KEITH BUSH CHIEF FINANCIAL OFFICER AND SENIOR VICE PRESIDENT 7

THIRD QUARTER PERFORMANCE • Delivered solid third quarter • Total revenue was $494 million, within outlook range, strong operating cash flow • Making progress and acting with urgency to transform into four new focus areas • Payments • Cloud • Promotional Products • Checks • Marketing solutions and other services revenue expanded to 44% of total revenue, checks 39% and forms & accessories 17% 8

EPS & NON-CASH ASSET IMPAIRMENT • GAAP diluted loss per share, $7.49 • Includes non-cash impairment charge • Employee severance costs • Facility closure costs • Non-Cash Asset Impairment: • Softness in web services and data-driven marketing • Exiting certain customer contracts • Sustained decline in the company’s stock price • New strategy is focused on integration • Recent wins like Ingram Micro and Vodaphone India signs that strategy is working • Remain bullish about future growth opportunities • Committed to deliver 2023 growth plans shared previously 9

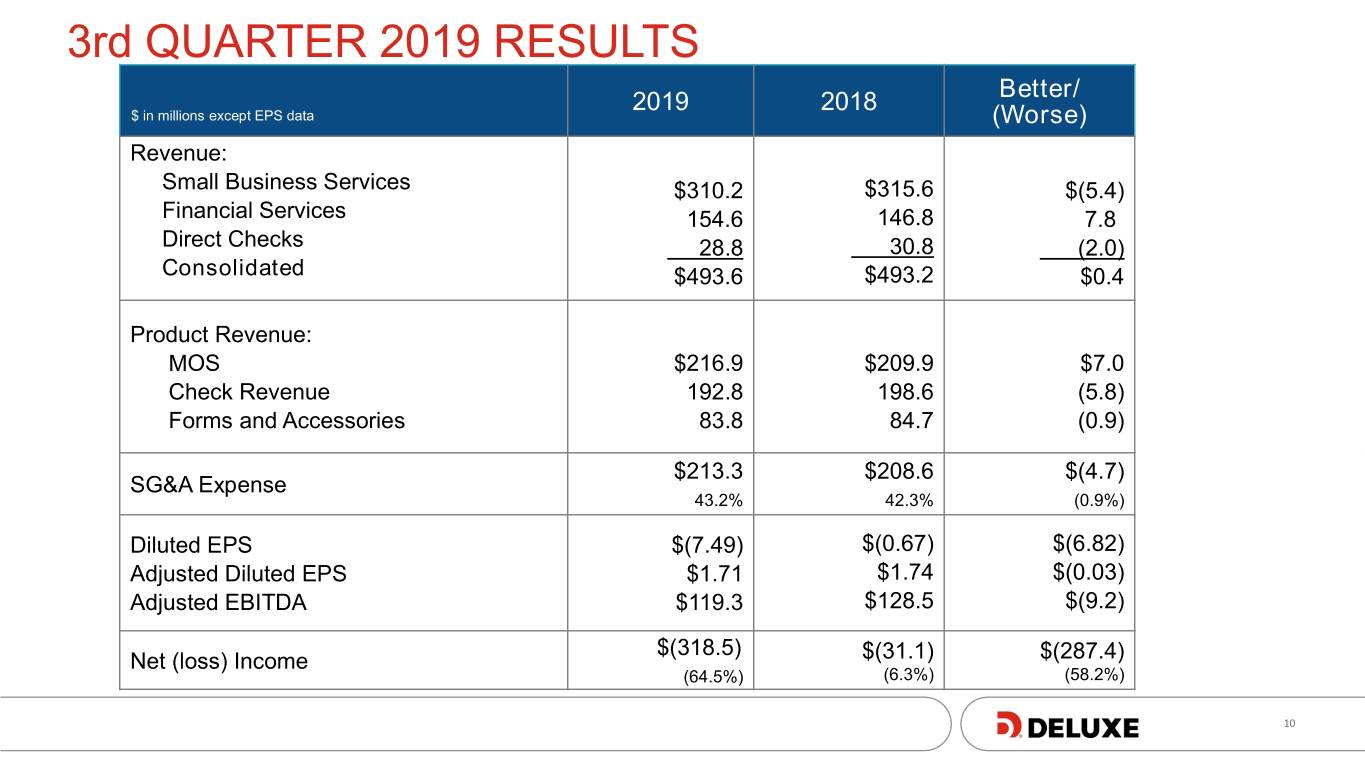

3rd QUARTER 2019 RESULTS Better/ 2019 2018 $ in millions except EPS data (Worse) Revenue: Small Business Services $310.2 $315.6 $(5.4) Financial Services 154.6 146.8 7.8 Direct Checks 28.8 30.8 (2.0) Consolidated $493.6 $493.2 $0.4 Product Revenue: MOS $216.9 $209.9 $7.0 Check Revenue 192.8 198.6 (5.8) Forms and Accessories 83.8 84.7 (0.9) $213.3 $208.6 $(4.7) SG&A Expense 43.2% 42.3% (0.9%) Diluted EPS $(7.49) $(0.67) $(6.82) Adjusted Diluted EPS $1.71 $1.74 $(0.03) Adjusted EBITDA $119.3 $128.5 $(9.2) $(318.5) Net (loss) Income $(31.1) $(287.4) (64.5%) (6.3%) (58.2%) 10

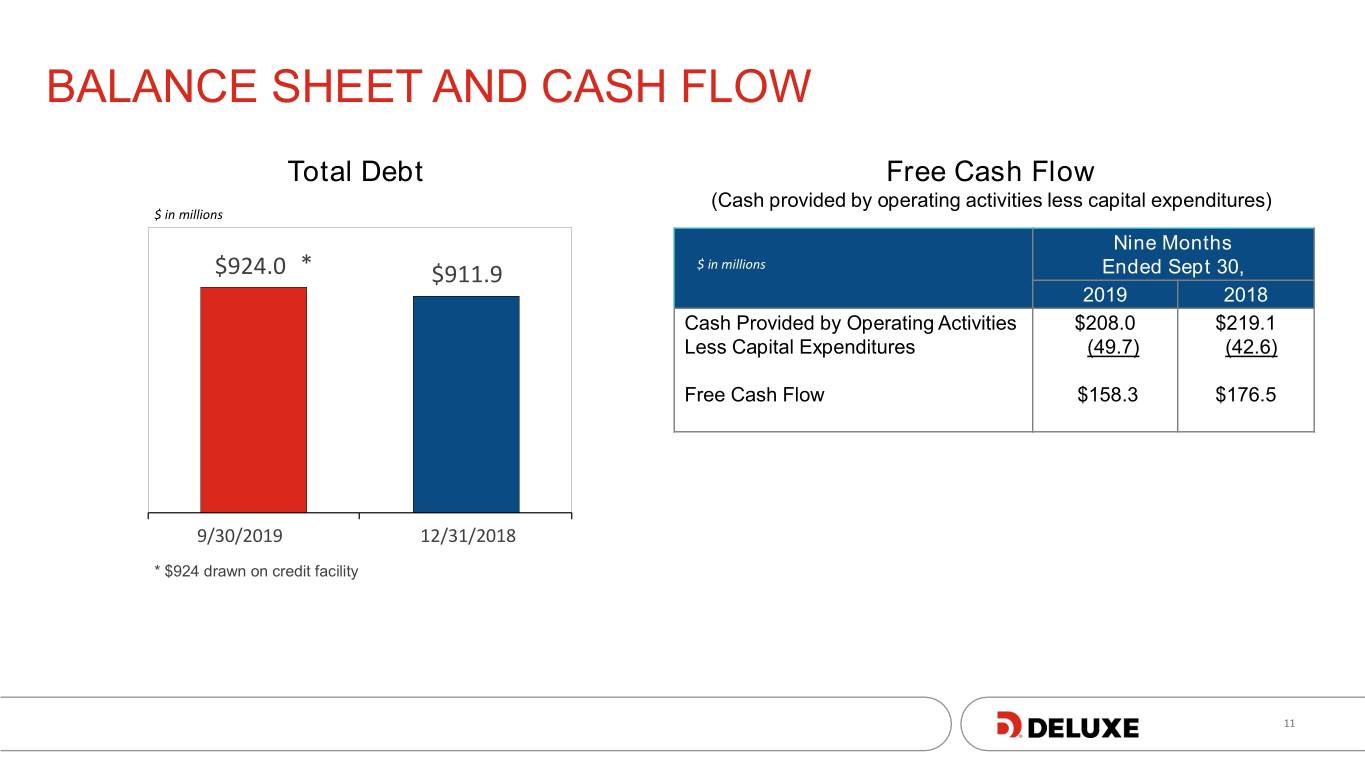

BALANCE SHEET AND CASH FLOW Total Debt Free Cash Flow (Cash provided by operating activities less capital expenditures) $ in millions Nine Months $ in millions $924.0$946.0 * $911.9$911.9 Ended Sept 30, 2019 2018 Cash Provided by Operating Activities $208.0 $219.1 Less Capital Expenditures (49.7) (42.6) Free Cash Flow $158.3 $176.5 9/30/20196/30/2019 12/31/201812/31/2018 * $924 drawn on credit facility 11

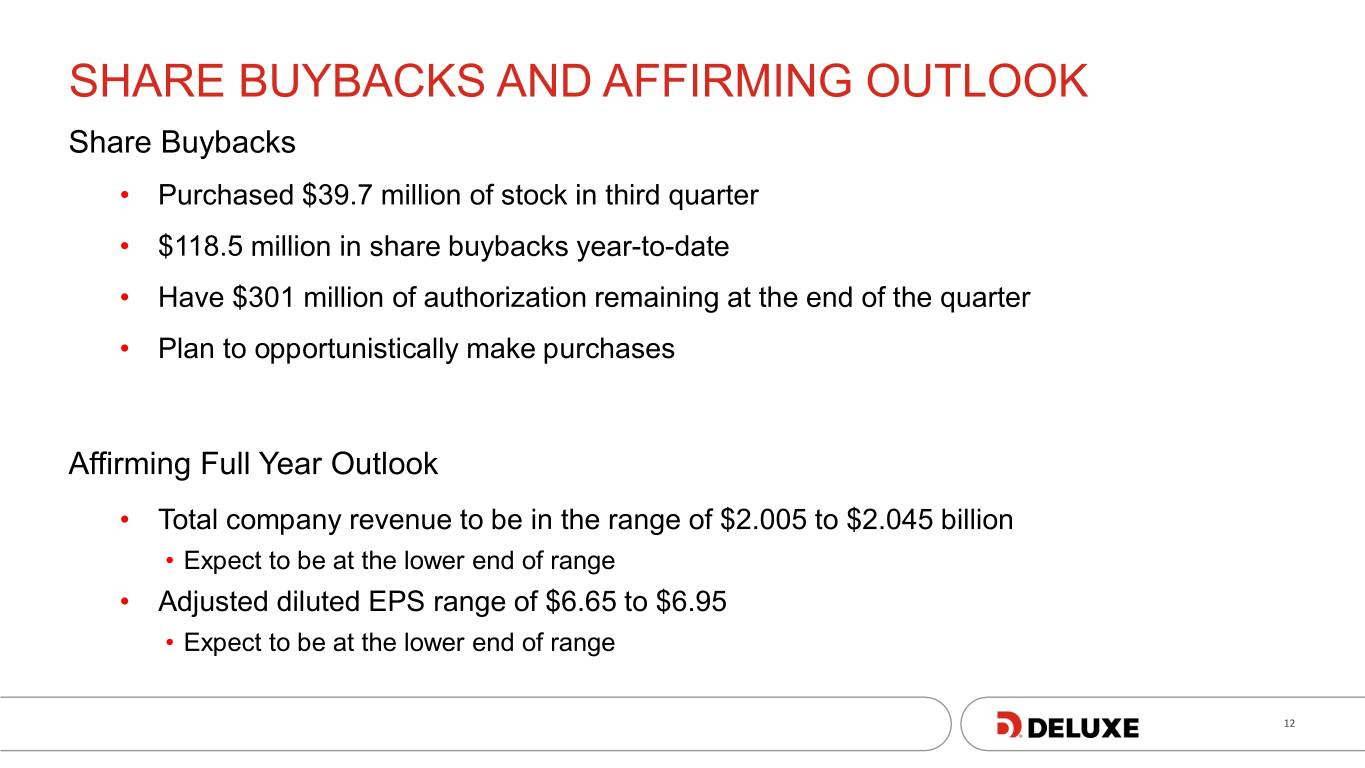

SHARE BUYBACKS AND AFFIRMING OUTLOOK Share Buybacks • Purchased $39.7 million of stock in third quarter • $118.5 million in share buybacks year-to-date • Have $301 million of authorization remaining at the end of the quarter • Plan to opportunistically make purchases Affirming Full Year Outlook • Total company revenue to be in the range of $2.005 to $2.045 billion • Expect to be at the lower end of range • Adjusted diluted EPS range of $6.65 to $6.95 • Expect to be at the lower end of range 12

BARRY McCARTHY PRESIDENT AND CHIEF EXECUTIVE OFFICER 13

TRANSFORMATION PROGRESS • Making progress on transformation, deep sense of urgency • Strategy focused on profitable revenue growth in two key areas: • Payments • Cloud • Aiming for nice growth in Promotional Products • 2023 targets, approximately $2.3 billion revenue, low-to-mid 20’s margins • Great foundation of assets to build upon THIS IS THE NEW DELUXE 14

STRONG FOUNDATION OF ASSETS • Nearly 5 million small business customers • 4.5 million hosted small business websites (directly and indirectly) • +4,600 financial institution customers • Our customers want to do more with us, we need to make that easier • We are changing our go-to-market strategy 15

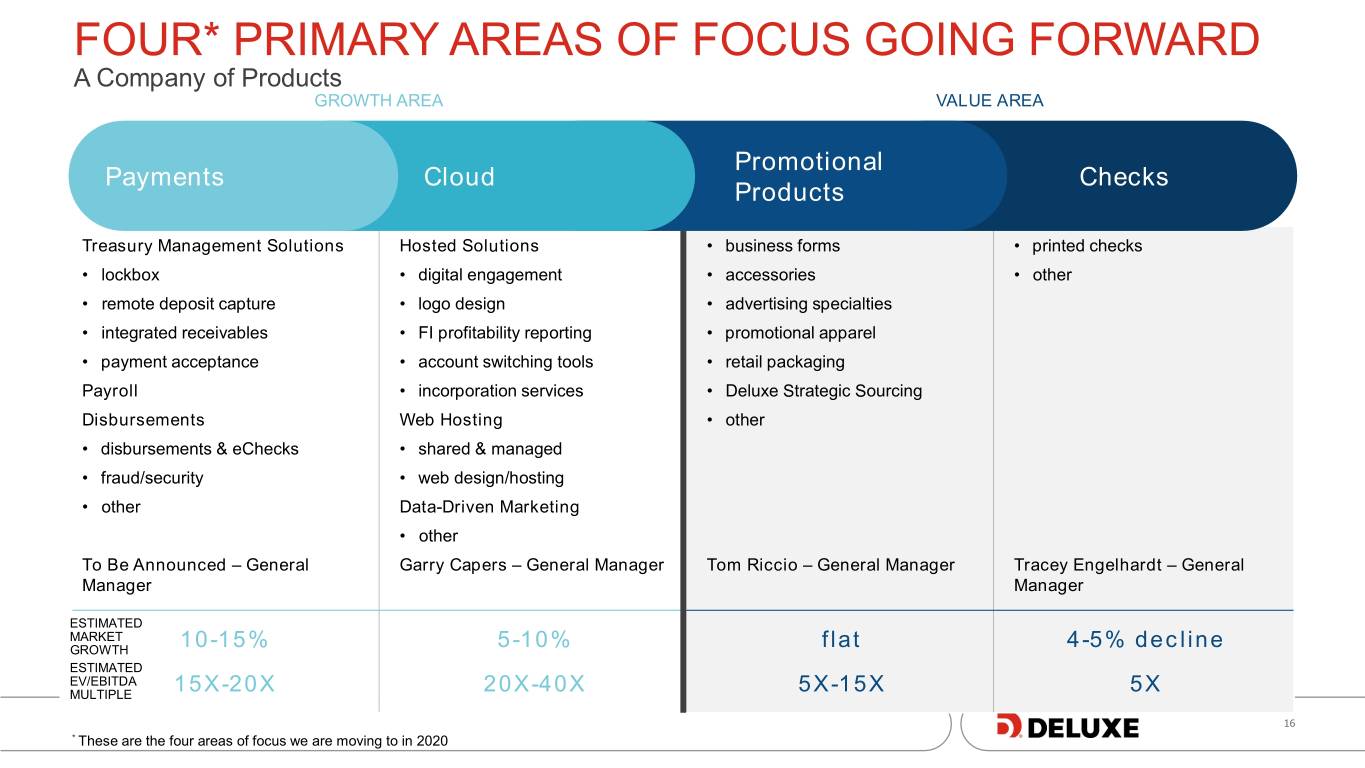

FOUR* PRIMARY AREAS OF FOCUS GOING FORWARD A Company of Products GROWTH AREA VALUE AREA PromotionalPromotional PaymentsPayments CloudCloud ChecksChecks ProductsProducts Treasury Management Solutions Hosted Solutions • business forms • printed checks • lockbox • digital engagement • accessories • other • remote deposit capture • logo design • advertising specialties • integrated receivables • FI profitability reporting • promotional apparel • payment acceptance • account switching tools • retail packaging Payroll • incorporation services • Deluxe Strategic Sourcing Disbursements Web Hosting • other • disbursements & eChecks • shared & managed • fraud/security • web design/hosting • other Data-Driven Marketing • other To Be Announced – General Garry Capers – General Manager Tom Riccio – General Manager Tracey Engelhardt – General Manager Manager ESTIMATED MARKET GROWTH 10-15% 5-10% flat 4-5% decline ESTIMATED EV/EBITDA MULTIPLE 15X-20X 20X-40X 5X-15X 5X 16 * These are the four areas of focus we are moving to in 2020

FOCUS BUSINESS UPDATE • Payments: Treasury Management winning new customers, Payroll starting to sell through financial institutions, eChecks continues to grow, new leader expected to be announced in the coming weeks • Cloud-based solutions: Growth through new reseller relationships, new business with Ingram Micro and Vodaphone India, new relationships for FMCG, new GM – Garry Capers, experienced senior executive • Promotional Products: new GM – Tom Riccio, experienced senior executive • Checks: won major bank check customer, GM – Tracey Englehardt, experienced executive promoted from within Deluxe 17

NEW DAY TECHNOLOGY INITIATIVES • Salesforce (CRM), Barry to speak at Dreamforce event in San Francisco • Workday (HR), expect to go-live January 1st, 2020 • S4/Hana selected as ERP solution, IBM selected as implementation partner 18

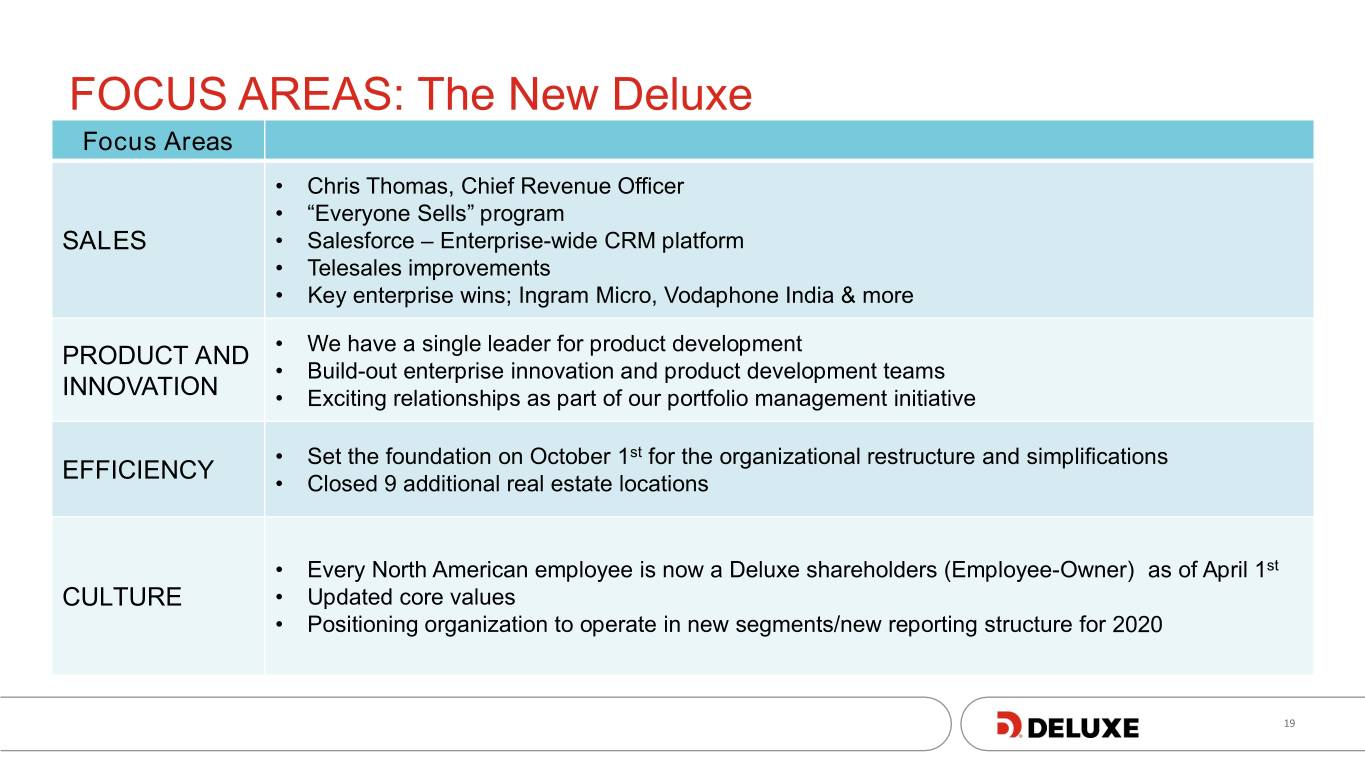

FOCUS AREAS: The New Deluxe Focus Areas • Chris Thomas, Chief Revenue Officer • “Everyone Sells” program SALES • Salesforce – Enterprise-wide CRM platform • Telesales improvements • Key enterprise wins; Ingram Micro, Vodaphone India & more • We have a single leader for product development PRODUCT AND • Build-out enterprise innovation and product development teams INNOVATION • Exciting relationships as part of our portfolio management initiative • Set the foundation on October 1st for the organizational restructure and simplifications EFFICIENCY • Closed 9 additional real estate locations • Every North American employee is now a Deluxe shareholders (Employee-Owner) as of April 1st CULTURE • Updated core values • Positioning organization to operate in new segments/new reporting structure for 2020 19

QUESTIONS & ANSWERS

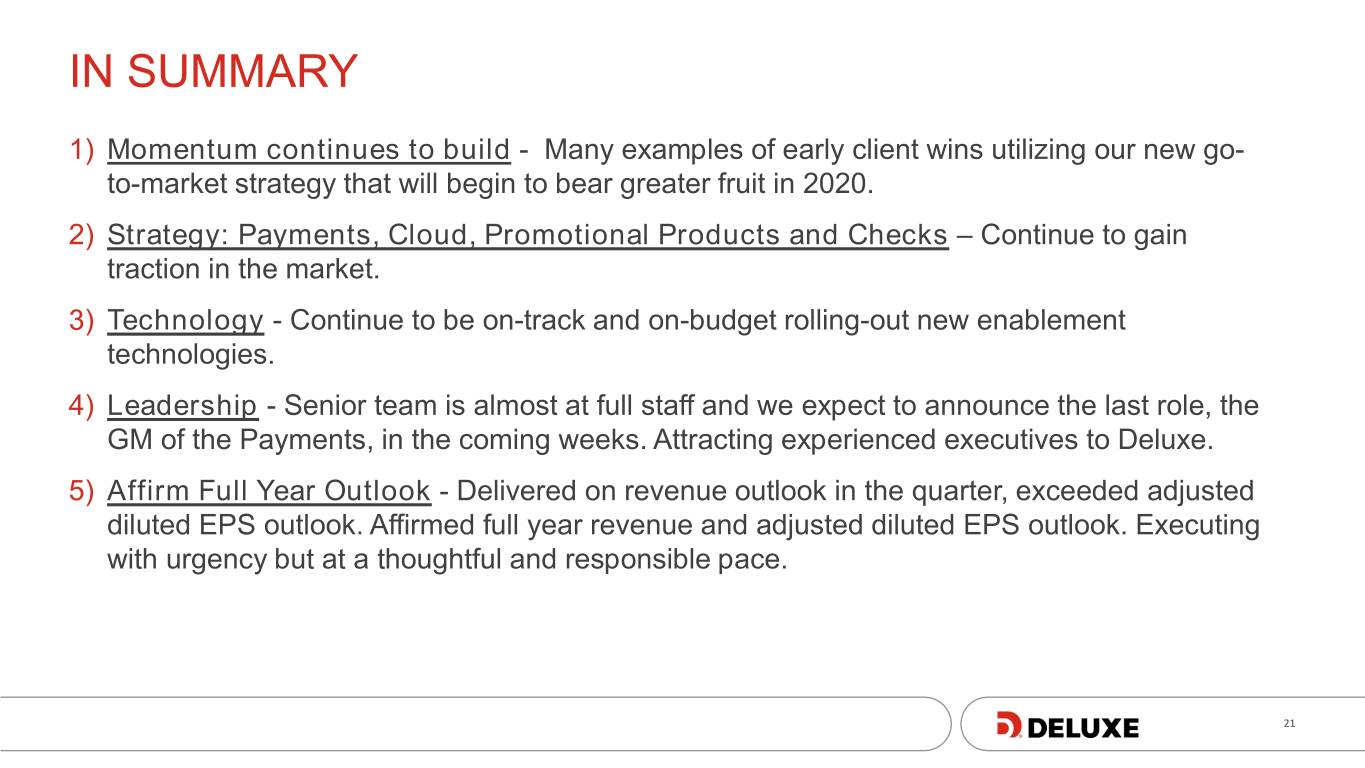

IN SUMMARY 1) Momentum continues to build - Many examples of early client wins utilizing our new go- to-market strategy that will begin to bear greater fruit in 2020. 2) Strategy: Payments, Cloud, Promotional Products and Checks – Continue to gain traction in the market. 3) Technology - Continue to be on-track and on-budget rolling-out new enablement technologies. 4) Leadership - Senior team is almost at full staff and we expect to announce the last role, the GM of the Payments, in the coming weeks. Attracting experienced executives to Deluxe. 5) Affirm Full Year Outlook - Delivered on revenue outlook in the quarter, exceeded adjusted diluted EPS outlook. Affirmed full year revenue and adjusted diluted EPS outlook. Executing with urgency but at a thoughtful and responsible pace. 21

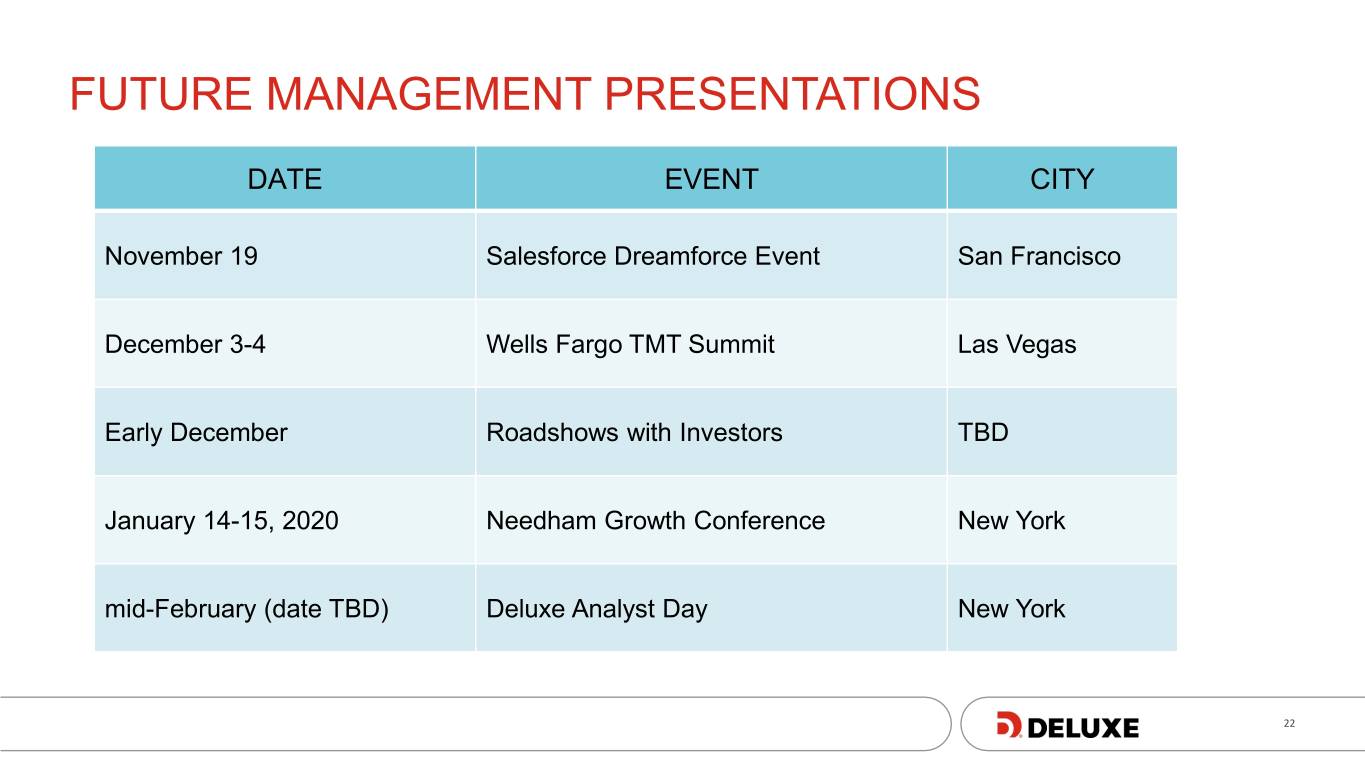

FUTURE MANAGEMENT PRESENTATIONS DATE EVENT CITY November 19 Salesforce Dreamforce Event San Francisco December 3-4 Wells Fargo TMT Summit Las Vegas Early December Roadshows with Investors TBD January 14-15, 2020 Needham Growth Conference New York mid-February (date TBD) Deluxe Analyst Day New York 22

REPLAY OF THIS CALL • Audio replay available through October 31 • Dial: 1-404-537-3406 • Access code: 9170599 • Presentation slides: • Deluxe’s investor relations website at deluxe.com/investor 23

Investor Relations Tel: 651-787-1370 ed.merritt@deluxe.com