EXHIBIT 99.2

Published on April 22, 2021

Exhibit 99.2

© 2021 Deluxe Corporation Deluxe to Acquire First American April 22, 2021

2 Cautionary Statement Statements made in this presentation concerning Deluxe, the Company’s or management’s intentions, expectations, outlook or pr edi ctions about future results or events are “forward - looking statements” within the meaning of the Private Securities Litigation Reform A ct of 1995. Such statements reflect management’s current intentions or beliefs and are subject to risks and uncertainties that could caus e a ctual results or events to vary from stated expectations, which variations could be material and adverse. Factors that could produce such a va riation include, but are not limited to, the following: potential continuing negative impacts from pandemic health issues, such as th e c oronavirus / COVID - 19, along with the impact of government restrictions or similar directives on the Company’s future results of operations, the Company’s future financial condition and the Company’s ability to continue business activities in affected regions; the impac t t hat further deterioration or prolonged softness in the economy may have on demand for the Company’s products and services; the Company’s abi lity to execute its transformational strategy and to realize the intended benefits; the inherent unreliability of earnings, revenue a nd cash flow predictions due to numerous factors, many of which are beyond the Company’s control; declining demand for the Company’s check s, check - related products and services and business forms; risks that the Company’s strategies intended to drive sustained revenue and ea rnings growth, despite the continuing decline in checks and forms, are delayed or unsuccessful; intense competition; continued conso lid ation of financial institutions and/or additional bank failures, thereby reducing the number of potential customers and referral sourc es and increasing downward pressure on the Company’s revenue and gross profit; the risk the contemplated transaction and/or any other future ac qui sitions will not be consummated; risks that any such acquisitions do not produce the anticipated results or synergies; risks that the Comp any ’s cost reduction initiatives will be delayed or unsuccessful; performance shortfalls by one or more of the Company’s major suppliers , l icensors or service providers; unanticipated delays, costs and expenses in the development and marketing of products and services, includ ing web services and financial technology and treasury management solutions; the failure of such products and services to deliver the ex pected revenues and other financial targets; risks related to security breaches, computer malware or other cyber - attacks; risks of inte rruptions to the Company’s website operations or information technology systems; risks of unfavorable outcomes and the costs to defend litigat ion and other disputes; and the impact of governmental laws, regulations or investigations. The Company’s forward - looking statements speak onl y as of the time made, and management assumes no obligation to publicly update any such statements. Additional information concerning the se and other factors that could cause actual results and events to differ materially from the company’s current expectations are con tai ned in the Company’s Form 10 - K for the year ended December 31, 2020. The Company undertakes no obligation to update or revise any forward - looking statements to reflect subsequent events, new information or future circumstances.

3 +

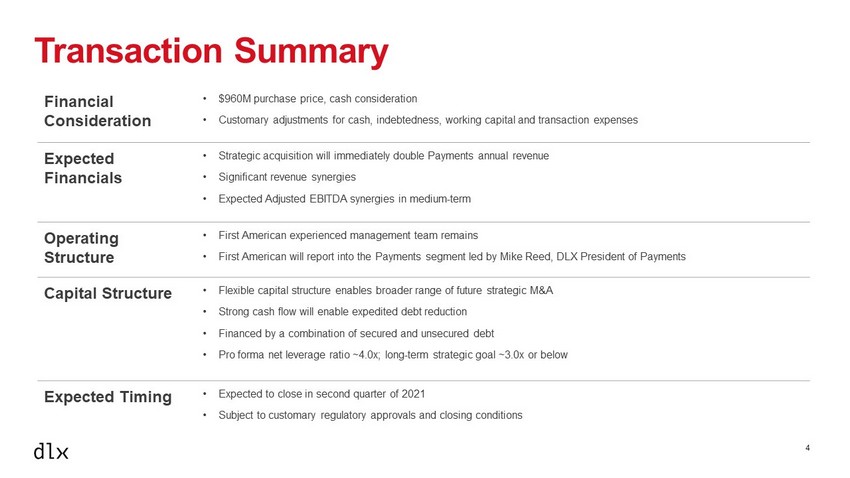

4 Transaction Summary Financial Consideration • $960M purchase price, cash consideration • Customary adjustments for cash, indebtedness, working capital and transaction expenses Expected Financials • Strategic acquisition will immediately double Payments annual revenue • Significant revenue synergies • Expected Adjusted EBITDA synergies in medium - term Operating Structure • First American experienced management team remains • First American will report into the Payments segment led by Mike Reed, DLX President of Payments Capital Structure • Flexible capital structure enables broader range of future strategic M&A • Strong cash flow will enable expedited debt reduction • Financed by a combination of secured and unsecured debt • Pro forma net leverage ratio ~4.0x; long - term strategic goal ~3.0x or below Expected Timing • Expected to close in second quarter of 2021 • Subject to customary regulatory approvals and closing conditions

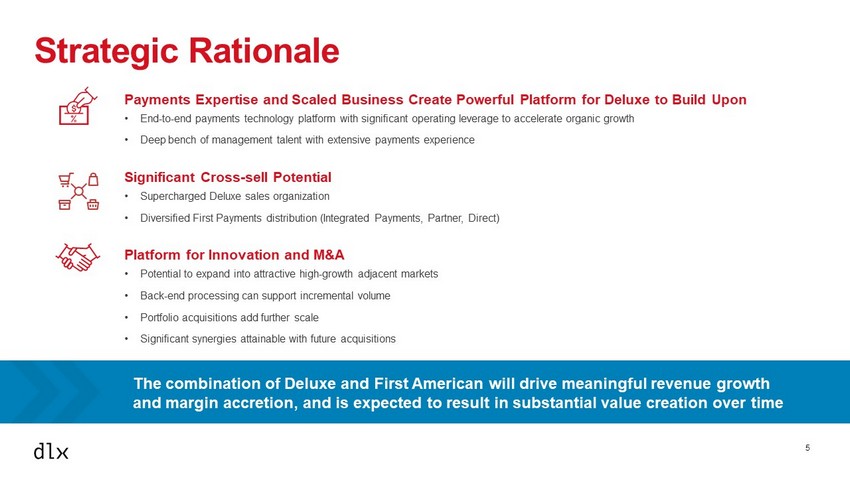

5 Strategic Rationale Payments Expertise and Scaled Business Create Powerful Platform for Deluxe to Build Upon • End - to - end payments technology platform with significant operating leverage to accelerate organic growth • Deep bench of management talent with extensive payments experience Significant Cross - sell Potential • Supercharged Deluxe sales organization • Diversified First Payments distribution (Integrated Payments, Partner, Direct) Platform for Innovation and M&A • Potential to expand into attractive high - growth adjacent markets • Back - end processing can support incremental volume • Portfolio acquisitions add further scale • Significant synergies attainable with future acquisitions The combination of Deluxe and First American will drive meaningful revenue growth and margin accretion, and is expected to result in substantial value creation over time

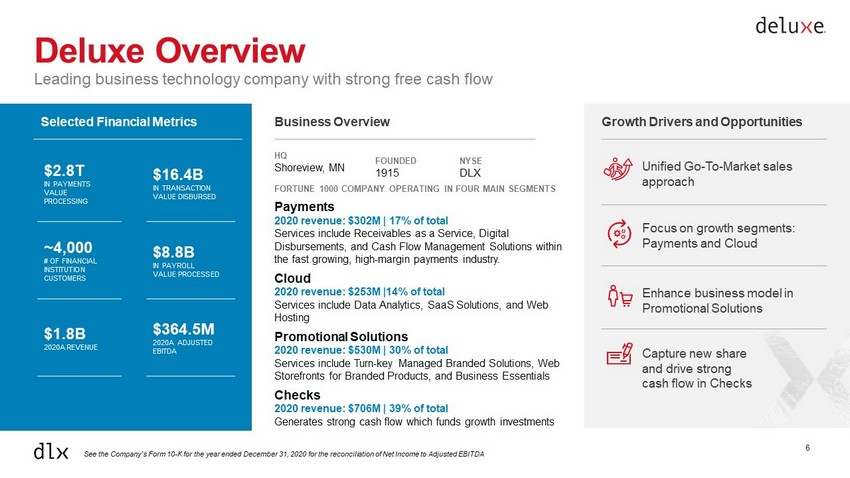

6 Deluxe Overview Leading business technology company with strong free cash flow Selected Financial Metrics $2.8T IN PAYMENTS VALUE PROCESSING ~4,000 # OF FINANCIAL INSTITUTION CUSTOMERS $1.8B 2020A REVENUE Business Overview HQ Shoreview, MN FORTUNE 1000 COMPANY OPERATING IN FOUR MAIN SEGMENTS Payments 2020 revenue: $302M | 17% of total Services include Receivables as a Service, Digital Disbursements, and Cash Flow Management Solutions within the fast growing, high - margin payments industry. Cloud 2020 revenue: $253M |14% of total Services include Data Analytics, SaaS Solutions, and Web Hosting Promotional Solutions 2020 revenue: $530M | 30% of total Services include Turn - key Managed Branded Solutions, Web Storefronts for Branded Products, and Business Essentials Checks 2020 revenue: $706M | 39% of total Generates strong cash flow which funds growth investments FOUNDED 1915 NYSE DLX $16.4B IN TRANSACTION VALUE DISBURSED $8.8B IN PAYROLL VALUE PROCESSED $364.5M 2020A ADJUSTED EBITDA Growth Drivers and Opportunities Focus on growth segments: Payments and Cloud Capture new share and drive strong cash flow in Checks Unified Go - To - Market sales approach Enhance business model in Promotional Solutions See the Company’s Form 10 - K for the year ended December 31, 2020 for the reconciliation of Net Income to Adjusted EBITDA

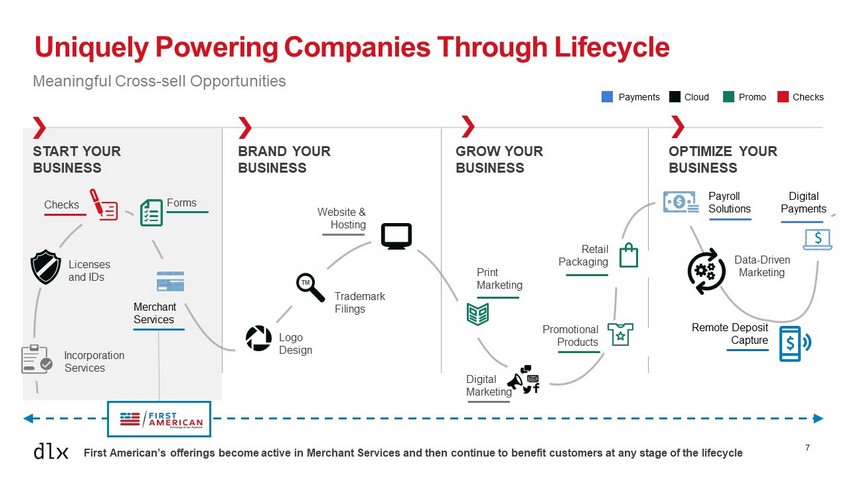

7 Uniquely Powering Companies Through Lifecycle Meaningful Cross - sell Opportunities START YOUR BUSINESS BRAND YOUR BUSINESS GROW YOUR BUSINESS OPTIMIZE YOUR BUSINESS Checks Cloud Promo Payments Merchant Services Payroll Solutions Remote Deposit Capture Digital Payments Website & Hosting Data - Driven Marketing Digital Marketing Logo Design Licenses and IDs Incorporation Services Trademark Filings TM Checks Forms Print Marketing Promotional Products Retail Packaging First American’s offerings become active in Merchant Services and then continue to benefit customers at any stage of the life cyc le

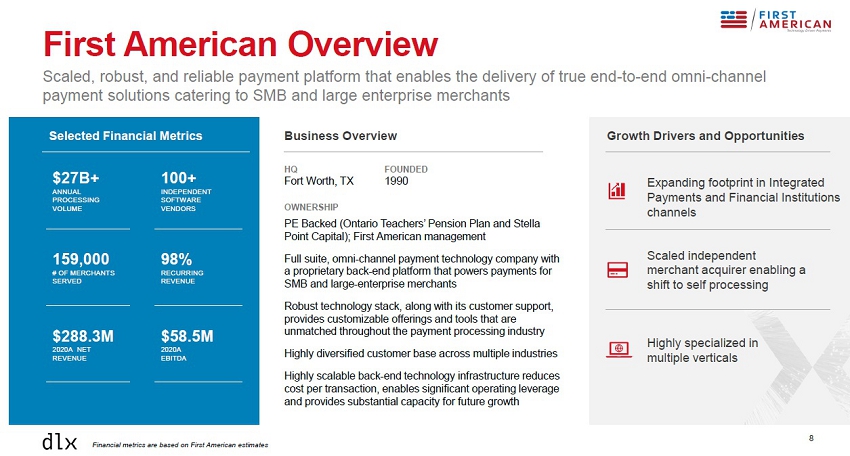

Growth Drivers and Opportunities 8 First American Overview Scaled, robust, and reliable payment platform that enables the delivery of true end - to - end omni - channel payment solutions catering to SMB and large enterprise merchants Business Overview HQ Fort Worth, TX OWNERSHIP PE Backed (Ontario Teachers’ Pension Plan and Stella Point Capital); First American management Full suite, omni - channel payment technology company with a proprietary back - end platform that powers payments for SMB and large - enterprise merchants Robust technology stack, along with its customer support, provides customizable offerings and tools that are unmatched throughout the payment processing industry Highly diversified customer base across multiple industries Highly scalable back - end technology infrastructure reduces cost per transaction, enables significant operating leverage and provides substantial capacity for future growth Selected Financial Metrics $27B+ ANNUAL PROCESSING VOLUME 159,000 # OF MERCHANTS SERVED $288.3M 2020A NET REVENUE 1,000+ INDEPENDENT SOFTWARE VENDORS 98% RECURRING REVENUE $58.5M 2020A EBITDA Scaled independent merchant acquirer enabling a shift to self processing Highly specialized in multiple verticals Expanding footprint in Integrated Payments and Financial Institutions channels FOUNDED 1990 Financial metrics are based on First American estimates

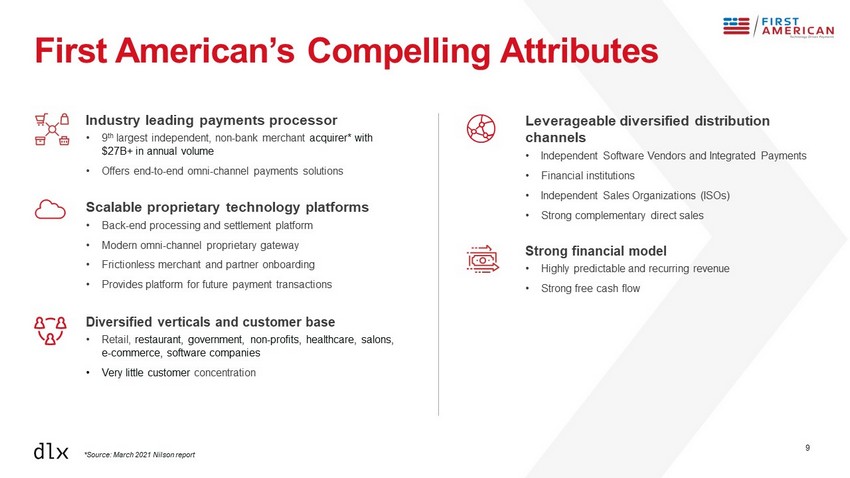

9 First American’s Compelling Attributes Leverageable diversified distribution channels • Independent Software Vendors and Integrated Payments • Financial institutions • Independent Sales Organizations (ISOs) • Strong complementary direct sales Strong financial model • Highly predictable and recurring revenue • Strong free cash flow Industry leading payments processor • 9 th largest independent, non - bank merchant acquirer* with $27B+ in annual volume • Offers end - to - end omni - channel payments solutions Scalable proprietary technology platforms • Back - end processing and settlement platform • Modern omni - channel proprietary gateway • Frictionless merchant and partner onboarding • Provides platform for future payment transactions Diversified verticals and customer base • Retail, restaurant, government, non - profits, healthcare, salons, e - commerce, software companies • Very little customer concentration *Source: March 2021 Nilson report

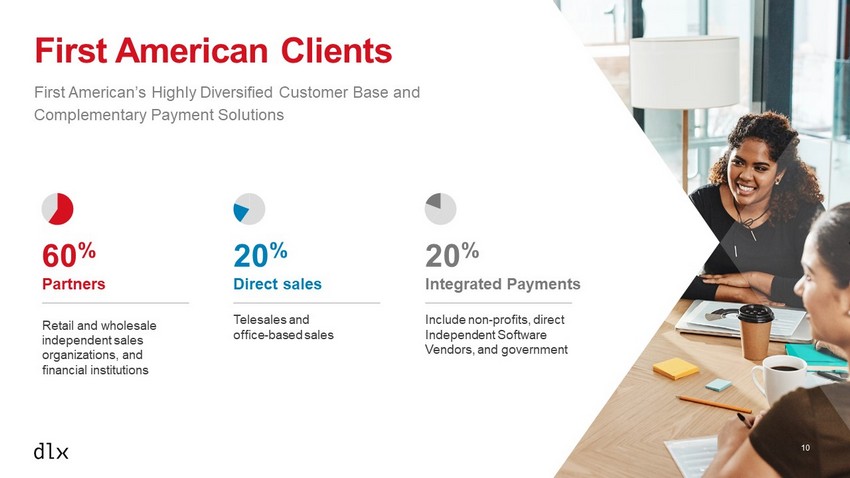

10 First American Clients First American’s Highly Diversified Customer Base and Complementary Payment Solutions 60 % Partners Retail and wholesale independent sales organizations, and financial institutions 20 % Direct sales Telesales and office - based sales 20 % Integrated Payments Include non - profits, direct Independent Software Vendors, and government

11 Significant Revenue Synergy Opportunities + Merchant Services to DLX FIs • Brings new adoption tools including Fitech Academy • Online banking connected offering via Autobooks Payroll to new First American merchants • Complementary to multiple selling channels like ISO, ISV / Integrated Payments, Banking, Non - Profit, Telesales and Office • Identified as a value - added service gap by First American Merchant Services to DLX SMBs • DLX can offer sticky products to core SMB base • DLX can drive improved retention and lifetime value Receivables to new First American non - profits • Enables full end - to - end donations processing • Complementary vertical to DLX Receivables Government merchant solutions to DLX FIs • Expands DLX relationship with FIs plus a new market • Complementary vertical to DLX Receivables

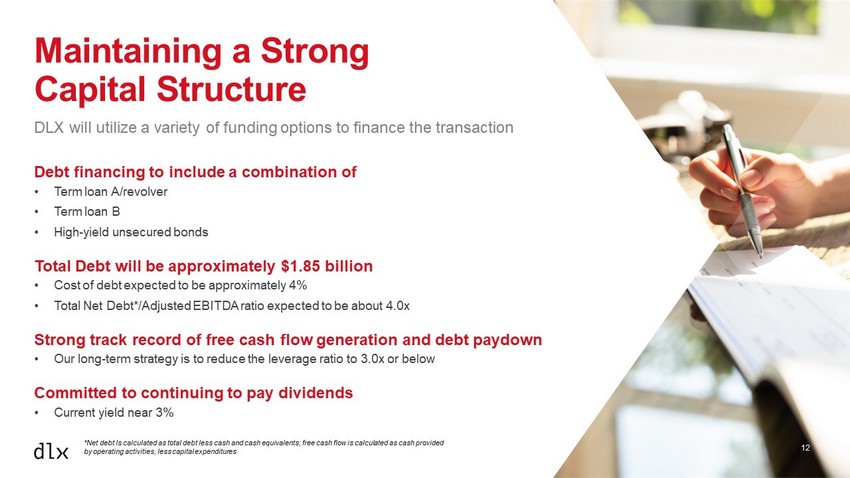

12 Maintaining a Strong Capital Structure Debt financing to include a combination of • Term loan A/revolver • Term loan B • High - yield unsecured bonds Total Debt will be approximately $1.85 billion • Cost of debt expected to be approximately 4% • Total Net Debt*/Adjusted EBITDA ratio expected to be about 4.0x Strong track record of free cash flow generation and debt paydown • Our long - term strategy is to reduce the leverage ratio to 3.0x or below Committed to continuing to pay dividends • Current yield near 3% DLX will utilize a variety of funding options to finance the transaction *Net debt Is calculated as total debt less cash and cash equivalents; free cash flow is calculated as cash provided by operating activities, less capital expenditures

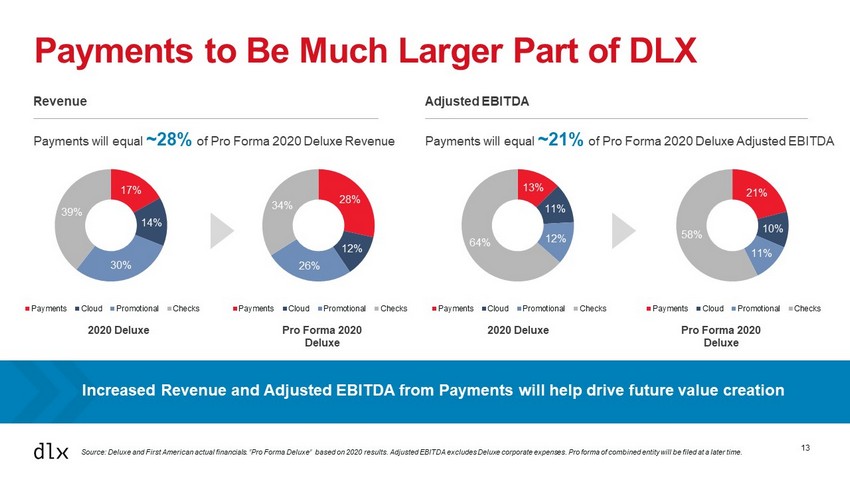

2020 Deluxe Pro Forma 2020 Deluxe 2020 Deluxe Pro Forma 2020 Deluxe Source: Deluxe and First American actual financials. ”Pro Forma Deluxe” based on 2020 results. Adjusted EBITDA excludes Delu xe corporate expenses. Pro forma of combined entity will be filed at a later time. 13 Payments to Be Much Larger Part of DLX Expense Synergies Early investments will lead to medium - term synergies Increased Revenue and Adjusted EBITDA from Payments will help drive future value creation Revenue Adjusted EBITDA Payments will equal ~28% of Pro Forma 2020 Deluxe Revenue Payments will equal ~21% of Pro Forma 2020 Deluxe Adjusted EBITDA 17% 14% 30% 39% Payments Cloud Promotional Checks 28% 12% 26% 34% Payments Cloud Promotional Checks 13% 11% 12% 64% Payments Cloud Promotional Checks 21% 10% 11% 58% Payments Cloud Promotional Checks

14 Strong Start to 2021 Q121 Revenues, Adjusted EBITDA, and Adjusted EPS expected to beat consensus 14 14 REVENUES Continued sequential improvement in year - over year rate of decline from fourth quarter 2020 ADJUSTED EBITDA 7 - 9% growth, year over year ADJUSTED EBITDA MARGIN Expanded year - over - year by 300 - 350 bps ADJUSTED EPS Beat consensus Additional Q121 details, and FY21 expectations for stand - alone DLX, on May 6th Q1 2021 Flash

15 Q&A